DDV Exit Readiness Accelerator

30 April, 2020

Identification, analysis, and value-oriented resolution of operational entanglements

You are about to divest a part of your company and ask yourself how you can successfully plan and execute the operational separation? Based on many years of experience advising on complex separation projects, our Carve-out experts have developed the Exit Readiness Accelerator – an exclusive PwC tool that enables the identification, analysis and value-oriented resolution of operational entanglements as part of a Carve-out. Especially at the beginning of a divestiture process, management can thereby quickly gain an overview of the separation complexity and underlying value drivers and define a common strategy for an efficient approach!

"With our Exit Readiness Accelerator, we offer clients an innovative solution to make the transition into the digital age in the area of Carve-outs, and to benefit from our vast expertise. With the Exit Readiness Accelerator, our clients can professionalize their Carve-out processes, systematically realize value drivers, and make the process more efficient!”

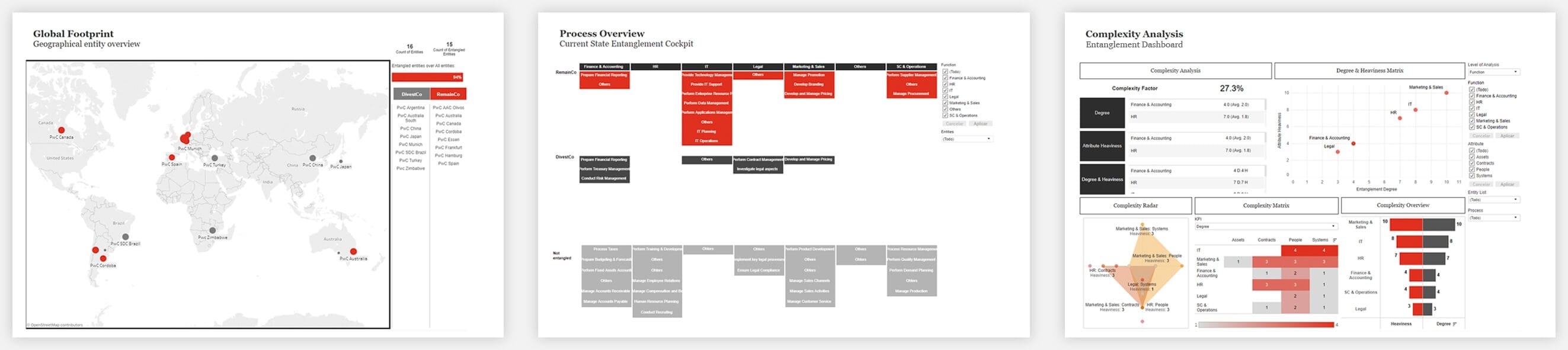

The Exit Readiness Accelerator is based on a consistent process-oriented methodology, with which the operational entanglements between the to-be divested business unit (DivestCo) and the remaining part of the company (RemainCo) can be captured and assessed across all relevant entities, processes and process attributes. On this basis, the complexity of the operational entanglements can be analyzed, and particularly critical interfaces can be identified. As a last step, the value-oriented resolution of the operational entanglements is planned via standardized solutions to transfer DivestCo into an operationally independent business unit and prepare it for the transition to the buyer.

Venture Deals - Video

Key features and methodology of our Exit Readiness Accelerator

Structured identification and evaluation of operational entanglements between the remaining part of the company (“RemainCo”) and the part of the company to be divested (“DivestCo”)

Various benchmark-oriented analysis options for the separation complexity of entities, functions, processes or process attributes

Definition of measures for the value-oriented resolution of the operational entanglements in order to prepare DivestCo for the transfer

The Exit Readiness Accelerator as a transition to digital-based workflows

The Exit Readiness Accelerator is based on our proven methodology with which we have successfully supported many clients during complex Carve-outs. This methodology builds on the following dimensions to identify, assess and resolve operational entanglements:

Entities: The basic unit of every operational business structure are entities, i.e. legal or organizational units that receive or perform services via processes

Functions: Within the organization and the entities, distinctive functions embody the respective responsibility for sub-areas of the service provision

Processes: The exchange relationships between the entities are shaped by one or more process-related links between RemainCo and DivestCo entities. In order to allow comparability of process-related links between different entities, these are defined based on the APQC standard process framework. Adjustments tailored to specific client process frameworks are possible.

Process attributes: Since a process cannot be performed self-sufficiently, it must always be supported by different process attributes. We differentiate between:

People: Employees / contractors providing services from RemainCo to DivestCo or vice versa

Contracts: Shared customer / supplier contracts / permits / licenses required to run the business

Assets: Tangible and intangible assets that are shared between RemainCo and DivestCo

Systems: Shared IT applications / systems / hardware / infrastructure

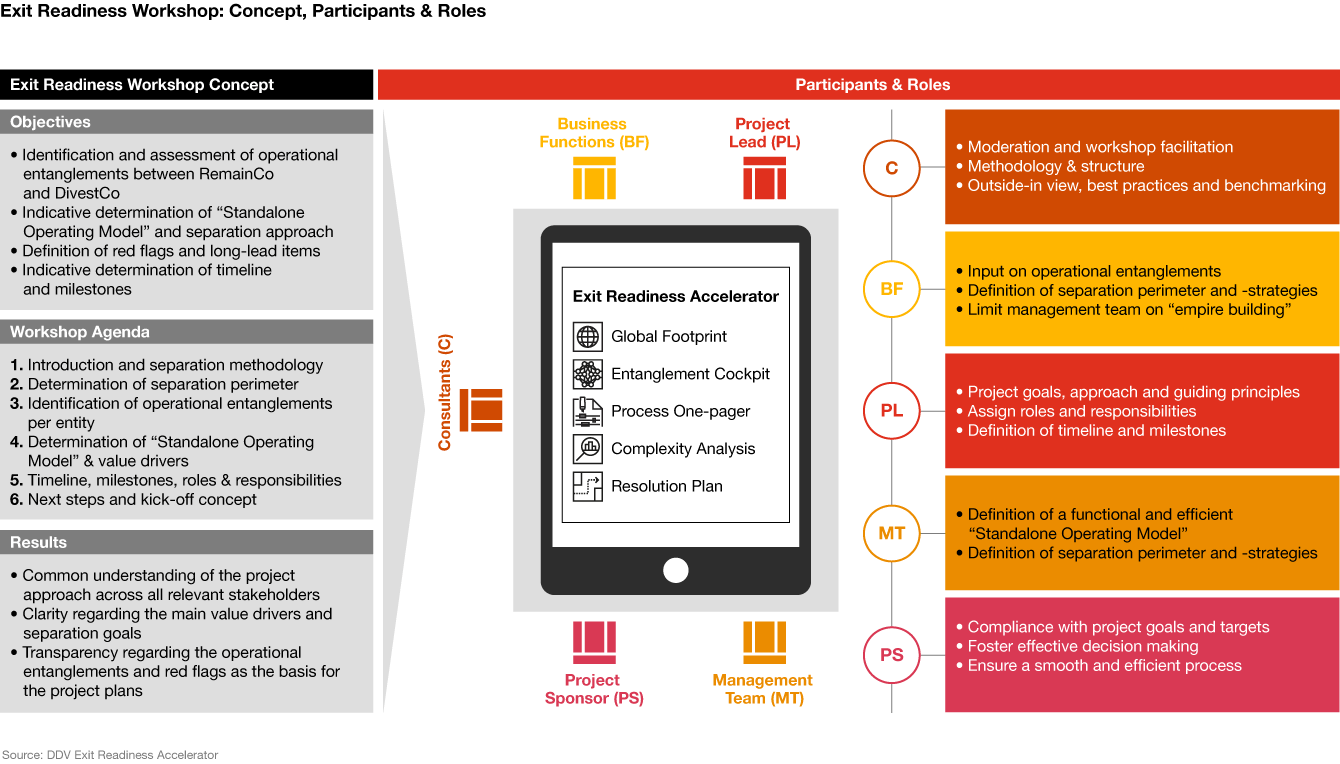

Exit Readiness Workshop as starting point for every Carve-out

Especially at the beginning of a Carve-out process there are many questions to be answered. It is important to quickly align on a joint approach to avoid uncertainties and to carry out the Carve-out process quickly, smoothly and in a value-oriented manner. For this purpose, we offer a well-established one-day workshop format with all relevant decision-makers based on the Digital Exit Readiness Accelerator. The advantage of our Exit Readiness Workshop? At the end of the day, the fundamental questions regarding objectives, approach, scope, and complexity of the operational entanglements and strategy for implementing a standalone solution are answered, and roles/ responsibilities clearly assigned. This is the basis for quickly gaining momentum and realizing the full value potential of the Carve-out.

Contact us

Partner, Deals Strategy and Operations Leader, Industries Leader, PwC Germany

Tel: +49 170 2064280