How COVID-19 is changing food retail

03 April, 2020

The fast spread of COVID-19 is causing a huge slowdown in many industries. Grocery retail is one of the few segments where sales are at a record high due to the crisis: in some cases, revenue has been more than 20% higher than during the same period in 2019. Whereas fresh produce was previously the main growth driver in the industry, non-perishable products are now in particular demand, such as tinned food, flour, rice, pasta – and toilet paper.

“The massive increase in demand for certain everyday items is leading to empty shelves in some supermarkets. Some of the changes currently visible in retail are indicative of a short-term crisis, but this pandemic will also bring about developments that will permanently change the sector.”

Four ways that COVID-19 could transform food retail in the long term

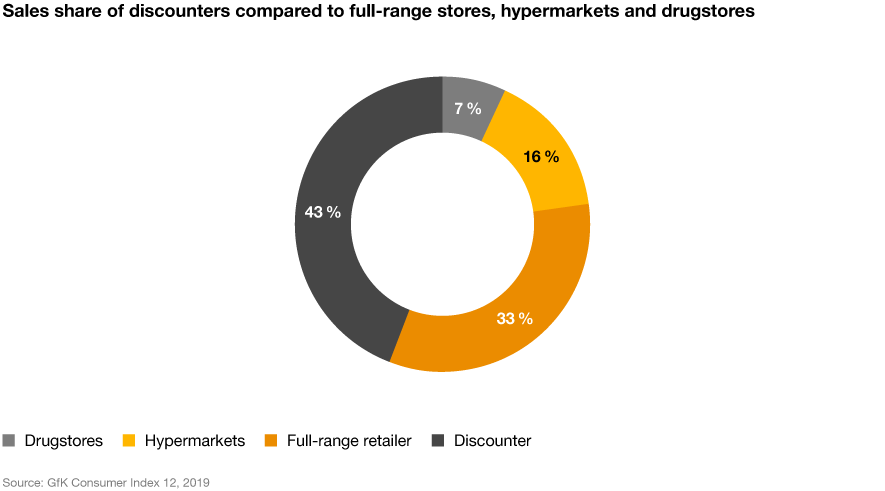

1. Discount supermarkets will win back market shares

In 2019, higher-end supermarkets offering a full range of products were able to gain market shares, focusing on freshness, organic products and creating a pleasant shopping experience. In this time of crisis, on the other hand, discount supermarkets are becoming more popular again. Consumers are currently focusing on quick and simple shopping, and they’re also becoming more price-sensitive due to economic uncertainty, short-time working and the expectation of increased unemployment. This development is likely to persist in the medium or longer term. We expect discount supermarkets to gain additional market shares of around 1.5% in 2021, much as happened after the 2008 financial crisis.

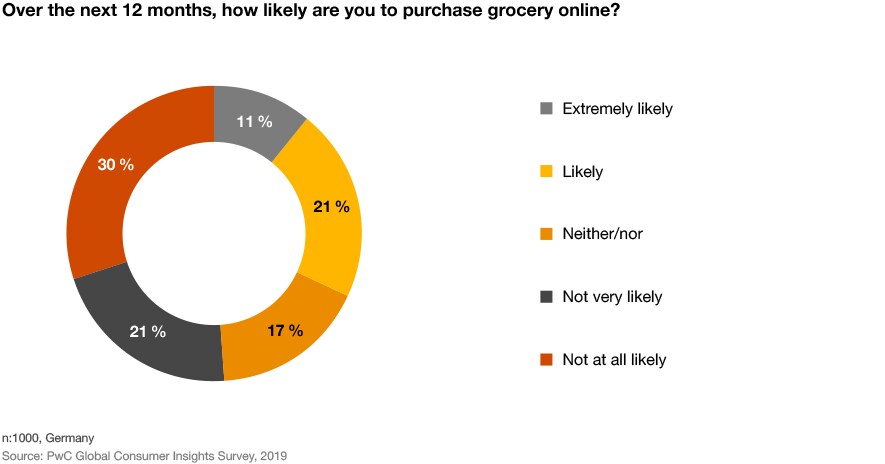

2. Home delivery will be here to stay

In times of curfew and increasing fear of catching COVID-19, people avoid interaction as much as possible – and this includes trips to the supermarket. This is helping home delivery of groceries to gain a foothold in Germany as well. We estimate that delivery services will grow from their current market share of just over 1% to 3-4% by 2023 – and continue to rise after this.

This means that companies will only be in a position to succeed in the long term if they can provide home delivery. Currently, however, delivery capacity is very limited, making it almost impossible for consumers to get their shopping delivered quickly. We are seeing retailers making huge efforts to improve this situation, in some cases trying out creative partnerships such as working together with taxi companies – which are particularly suffering in this crisis – to provide speedy deliveries. While increasing market shares is the current focus, the cost base will improve in the long term, ultimately enabling retailers to break even or make a profit on deliveries. Once this happens, there will be nothing to stop rapid growth of online food retail, and the new situation will offer an opportunity for higher-end retailers to avoid losing market share to discount supermarkets.

3. Packaging will come back into fashion

The pandemic is also leading to higher expectations of product hygiene: fearful of catching the virus, customers are tending to shy away from loose fruit, vegetables or bakery products. Reducing plastic waste was very much in vogue in 2019, but it now looks like this trend will be reversed – at least, partially. This is leading to a revival of packaging.

“It remains to be seen how food retailers will solve the issue of hygiene on a large scale. Possible solutions include using technologies such as blockchain in supply chains to guarantee transparency and product safety at all times.”

In the short term, however, returning to plastic – albeit in improved, biodegradable form – seems to be the only way of allaying consumer fears of becoming infected through food.

4. Digital payment methods will catch on

As it avoids the risk of spreading COVID-19 via coins and banknotes, cashless payment is now being widely promoted. If consumers get used to this – even for small payments – they will continue to use cashless payment methods after the crisis.

Compared to other countries, Germany is lagging behind with digital payment: while over 80% of payments in some South-East Asian countries and in Scandinavia are already cashless, the figure in Germany at the end of 2019 was just under 50%. PwC forecasts predict that this will rise to at least 60% by the end of 2020 and 80% by the end of 2023. Once consumers have got used to using new technologies such as ‘scan as you shop’ or self-checkouts, they won’t just accept these systems; they’ll actually prefer them in the long term. This means that investing in upgrading stores with this technology will give companies the competitive edge.

Conclusion

Digital transformation is needed as soon as possible

COVID-19 is changing consumer behaviour, and not just in the short term. Developments that we’re currently seeing in retail will become permanent changes. The challenge for retailers is to make their digital transformation as quickly as possible, so that they can provide the entire range of new technologies that consumers will get used to in this crisis.

Contact us