Deal Announcement 07/21: Industrial Products/Retail & Consumer

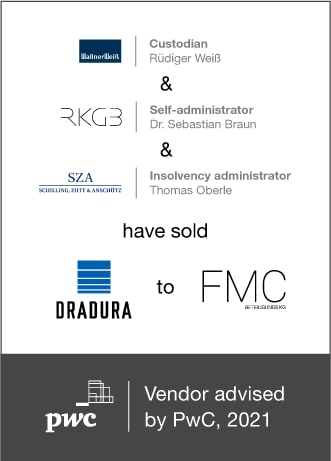

PwC acted as exclusive sell-side M&A advisor on the sale of Dradura to FMC

The Deal

The PwC M&A team is pleased to announce the successful sale of Dradura Group (“Dradura”) to FMC Beteiligungs KG (“FMC”).

Dradura ranks among the world’s leading manufacturers of high-quality wire products primarily for the white goods industry. Dradura's renowned customers include major household appliances manufacturers such as BSH, Electrolux, Miele, or Whirlpool.

Dradura was affected by COVID-19, which negatively impacted sales and profitability in 2020. As the company additionally had been facing a high leverage, the German operating entity DRADURA Holding GmbH & Co. KG as well as DRADURA Beteiligungs GmbH with shareholdings in the group’s international subsidiaries initiated insolvency proceedings. The insolvency proceedings in self-administration for DRADURA Holding GmbH & Co. KG were headed by attorney at law Dr. Sebastian Braun (Reinhart Kober Großkinsky Braun Rechtsanwälte), the Dradura Management with Matthias Kreye as CEO and Peter Brauer as CFO as well as attorney at law Rüdiger Weiß (WallnerWeiß) in his function as custodian. The financial advisors and restructuring experts Dipl.-Ing. Jörg Heus and Dipl.-Wirtsch.-Ing. Daniel Mann of AMBG supported the self-administration. Attorney at law Thomas Oberle (Schilling, Zutt & Anschütz) was appointed as insolvency administrator in regular insolvency proceedings for DRADURA Beteiligungs GmbH. Shortly after the insolvency filings, a structured, international sale process was started for Dradura.

Due to its excellent reputation, strong market position and highly attractive business development throughout 2021 after the first COVID-19-related lockdowns, Dradura drew strong interest from various strategic and financial investors in the course of the M&A process. FMC, a holding company with a strong expertise in special situations, succeeded in the highly competitive M&A process.

The asset and share purchase agreements were signed in June 2021 and the transaction was successfully closed on 1st of July 2021.

Dradura Group

Dradura, headquartered in Altleiningen (Rhineland-Palestine), is a leading supplier of high-quality wire products for white goods. The product portfolio includes baskets, grates and grids used for dishwashers, stoves and ovens as well as refrigerators and freezers. Additional solutions are manufactured for the bath and furniture, automotive and medical industry. In FY19/20, Dradura generated sales of €122m. Besides its headquarters in Altleiningen, the company operates further production sites in Poland, Italy as well as in the US with a total of approx. 1,000 employees.

FMC Beteiligungs KG

FMC Beteiligungs KG is a medium-sized, entrepreneur-driven investment company focusing on investments in special situations. The operational management has many years of cross-industry experience in crisis and turnaround management. This includes, in particular, a strong expertise in insolvency cases in a wide range of industries and sectors.

WallnerWeiß

With more than 15 offices, WallnerWeiß is a nationwide group of law firms specializing in corporate restructuring and operating exclusively in this field. Due to this focus, the scope of services covers the entire range of restructuring, in particular the support and implementation of out-of-court as well as judicial restructuring measures within the scope of self-administration. In addition, the insolvency administrators of WallnerWeiß are listed with more than 70 insolvency courts nationwide and are appointed in complex restructuring situations.

Reinhart Kober Großkinsky Braun

The law firm Reinhart Kober Großkinsky Braun advises and represents companies of all sizes, from craft businesses and medium-sized companies to international corporations. In addition, the client base includes freelancers, associations, local authorities, public institutions and, of course, private individuals. Dr. Sebastian Braun is a specialist in insolvency law and intellectual property law. He has been appointed as insolvency administrator in over 600 insolvency proceedings. In addition, he has acted as CRO (Chief Restructuring Officer) in numerous self-administration proceedings throughout Germany over the past 15 years, as well as in the area of out-of-court reorganization and restructuring consulting.

AMBG

With its business management and process-oriented restructuring and reorganization expertise, AMBG provides the backbone for strategic decisions within insolvency proceedings.

The main focus of the team of 20 consultants is the step by step support of the self-administrators (debtor in possession) throughout the proceedings on the basis of complex planning calculations, liquidity analyses and expert opinions. Managed by the CEOs, Jörg Heus and Daniel Mann, AMBG provides its services from 7 locations in Germany and has successfully completed more than 250 restructuring mandates.

Schilling, Zutt & Anschütz

The roots of Schilling, Zutt & Anschütz reach back more than 100 years. Today, the main focus of SZA is on corporate law, M&A, capital markets, banking & finance, labor law, antitrust law, intellectual property, competition law, business succession, trust law and public and administrative law as well as tax law and insolvency law. With more than 100 employees, SZA operates offices in Frankfurt, Mannheim, Munich and Brussels.

PwC

The global PricewaterhouseCoopers network is a worldwide association of independent auditing and consulting companies which together employ more than 280,000 people in 157 countries. Our global network comprises nearly 1,600 M&A professionals all over the world, realising approx. 400 successful transactions per year. We specialize in a wide range of independent M&A services including advice on acquisitions and disposals, mergers, public takeovers, privatizations as well as structured financing.

The transaction was led by Timo Klees (Partner) and Fabian Dalka (Senior Manager) and supported by Florian Middelkamp (Senior Associate), Georgios Chalkidis (Associate) and Matthias Friedl (Associate).

For more information please contact Timo Klees +49 (0) 69 9585-6614 or Fabian Dalka +49 (0) 69 9585-5537.

Contact us

Partner, Head of Corporate Finance | M&A Distressed & Special Situations, PwC Germany

Tel.: +49 151 10060451

Dr. Alexander von Friesen

Partner, Corporate Finance | M&A Healthcare & Consumer, PwC Germany

Tel.: +49 151 11714398