PwC Deals Study: How decision-makers evaluate the maturity and professionalism of the tools and methods they use to manage their company’s portfolio and operative structures

Mastering uncertainty and volatility

Strategic business steering in uncertain times

Volatility, uncertainty, complexity and ambiguity – these factors shape the market environment for many companies today, and will continue to do so for the foreseeable future. The reasons for this situation include new regulatory requirements, changing consumer preferences, risks related to the environment, and political conflicts. The far-reaching and long-term effects of technological disruptions such as digitisation also increase uncertainty and complexity. Furthermore, sudden and unexpected crises like the current Coronavirus pandemic lead to supply and demand shocks, as well as ad-hoc announcements or profit warnings.

This exclusive PwC study was conducted in cooperation with the market research company Kantar and the Technical University of Darmstadt. It provides answers to questions including: How are business decision-makers reacting to increasing uncertainty? How can they gather the information that is necessary when making strategic decisions? And how can they shape their approaches to managing their portfolio and their increasingly complex company structure?

“Business decision-makers need to significantly increase the professionalism and maturity of the tools and methods that they use to manage their company’s portfolio and operative structures. This is an essential prerequisite for making informed decisions and acting strategically in markets that are shaped by uncertainty and increasing complexity.”

An overview of the study

The first part of the study, “Optimism on uncertain grounds”, shows that business decision-makers in Germany, Austria and Switzerland display high levels of optimism and confidence. This is true in the context of the current Coronavirus pandemic and its consequences, as well as for the medium and long-term outlook.

The second part of the study has the title “Mastering uncertainty and volatility”. It builds on the first part by exploring the factors that shape the maturity and professionalism of the tools and methods that the surveyed decision-makers use to manage their company’s portfolio and operative structures. In particular, it focuses on the extent to which businesses invest in and make use of tools and methods for managing the company’s portfolio, transactions and business structures to master rising levels of uncertainty and complexity. It also examines how transparently and objectively they apply these tools and methods, and how consistently they implement the measures derived from them.

In December 2020, the third part of the study will be published. It has the title “Unlocking value through carve-outs”, and focuses on the role that transactions and carve-outs play as a strategic instrument for portfolio management.

An overview of the study results – Part 2

Our starting hypothesis for the second part of the study was: Markets are becoming increasingly dynamic, volatile and uncertain, so companies need to make their strategies and portfolios more flexible to be able to react to these constantly changing market conditions in an agile way. This includes developing and implementing increasingly mature and consistent tools and methods that enable them to gather the information they need in order to manage their business portfolio and operative footprint in a target-oriented manner.

The most important results at a glance

More companies have at least partially implemented an SFA (80.9%) than an OFA (72.7%). The level of maturity, measured in terms of transparency and objectivity, is also higher for an SFA (43.3%) than for an OFA (36%).

81.5% of decision-makers expect a linear or even exponential increase in the complexity of their company structures. However, they are still very hesitant about professionalising their management approaches – and are losing valuable preparation time as a result.

The maturity of the tools and methods for SFAs, OFAs and their implementation is either very strong or very weak – with very little in between.

Our results emphasise how important it is for business decision-makers to significantly increase the professionalism and maturity of their approaches to managing their portfolios and their company structures. The sooner they invest in suitable tools and methods for target-oriented steering of the business portfolio, transactions and operative company structures, the easier it will be to achieve their goals – and successfully steer their company in increasingly uncertain and complex markets.

Find out what answers we received from the decision-makers we surveyed.

Mastering uncertainty and volatility

- Strategic portfolio management

- Managing the operational footprint

Strategic portfolio management

High degree of implementation, but conducted in a little objective and inconsistent way

One of the key findings of our study is that 80.9 percent of the business decision-makers stated that their company had implemented a structured and institutionalised Strategic Fit Assessment (SFA), either fully or partially.

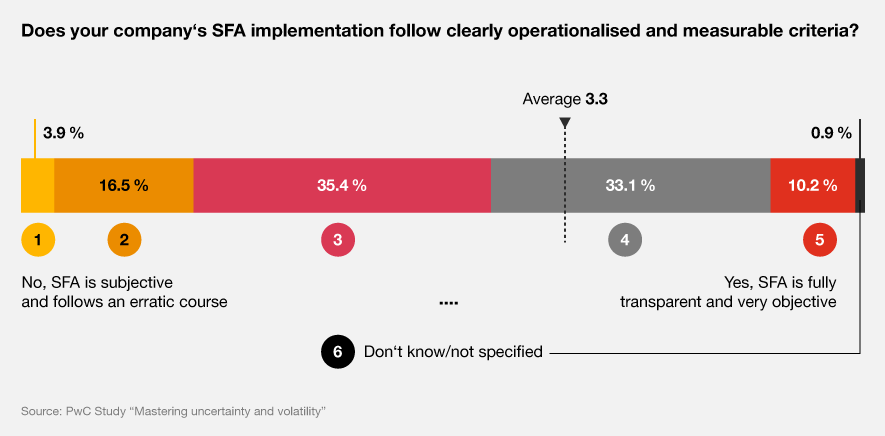

However, less than half of respondents (43.3 percent) conducted the SFA in line with transparent and objective criteria. In fact, 20.4 percent of the respondents stated that they believe the SFA was conducted in a more subjective and erratic manner.

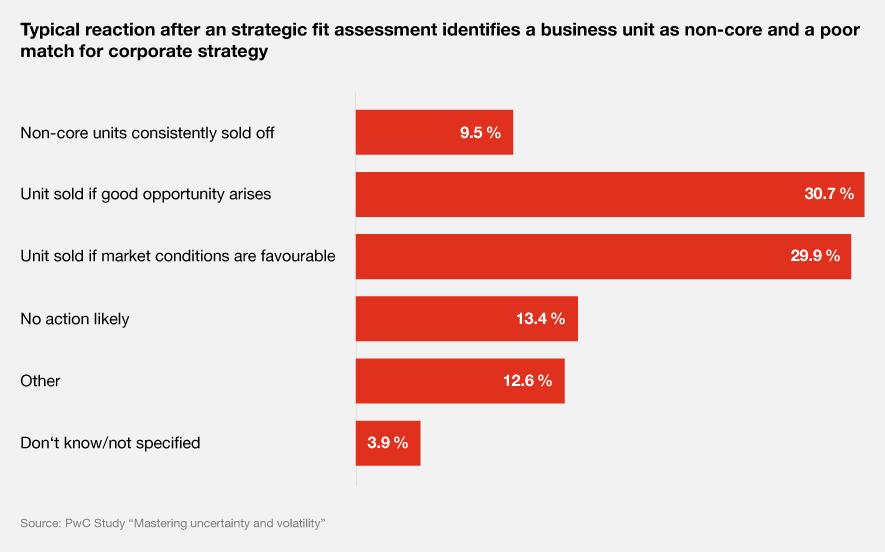

Only 9.5 percent of the decision-makers surveyed stated that they would sell a business unit quickly if the SFA found that it did not contribute to their core business and was not an optimal fit for their business strategy. 30.7 percent of the respondents said they would only sell a business unit if there was a good opportunity to do so, while 29.9 percent would only sell a business unit if the market conditions were favourable. 13.4 percent stated that they would not take any action based on SFA findings of this kind.

“The maturity of strategic tools and methods is either very strong or very weak – with very little in between. This means the first step is the biggest challenge. Once companies take that step, the further professionalisation is comparatively simple.”

Managing the operational footprint

Business structures are becoming increasingly complex, but the tools and methods for managing them often lack professionalism

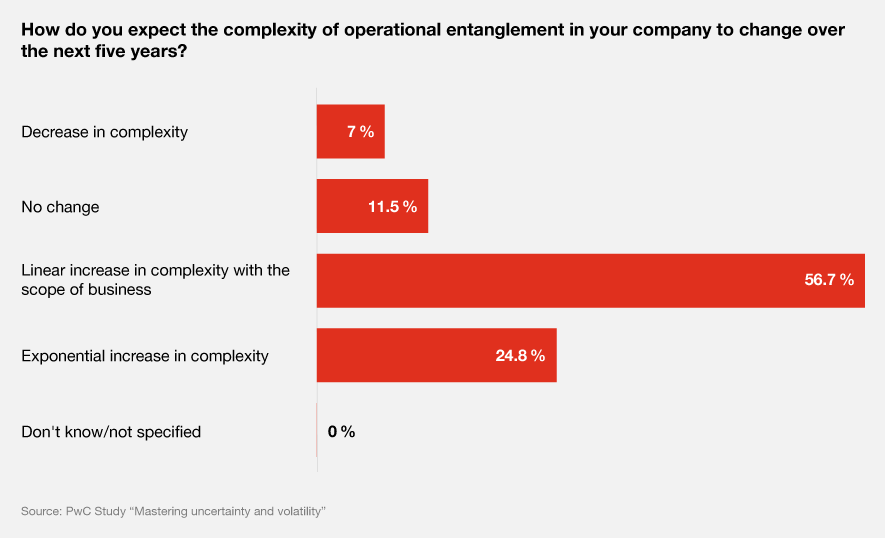

More than half of the decision-makers surveyed (56.7 %) expect a linear increase of the complexity of their operative business structures in the next five years. A further 24.8 percent anticipate an exponential increase in complexity. However, only 18.5 percent expect the level of complexity to decrease or stay the same.

“More than 8 out of 10 of the decision-makers surveyed expect the complexity of their company’s structures to increase. However, they too often hesitate to professionalise their management approaches accordingly. This means they miss the opportunity to prepare for this increased complexity well in advance.”

More complex operative structures make it more paramount that business decision-makers thoroughly understand these structures – the higher level of complexity brings more key interfaces and weak spots. This is the only way that they can manage these structures in an optimal manner and optimise them for an increasingly volatile market environment.

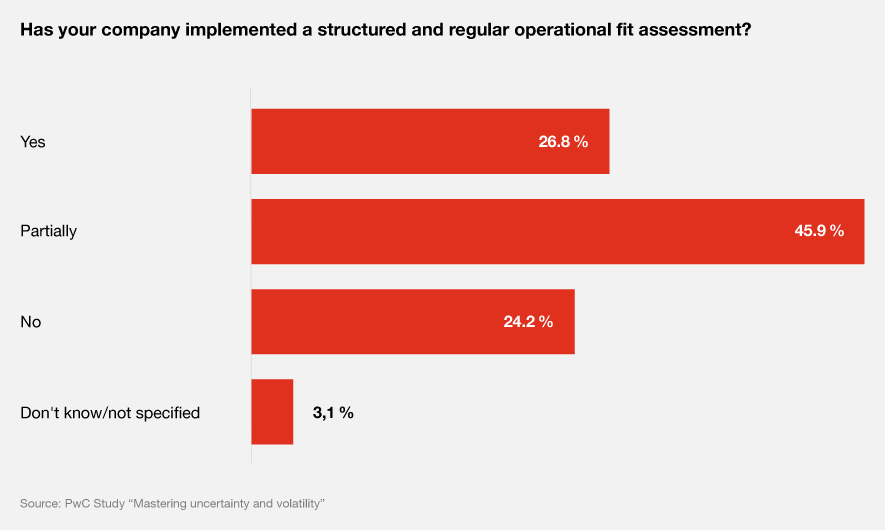

One of the key results from our study relates to this fact. 72.7 percent of the decision-makers stated that their company has implemented an OFA at least partially. Specifically, 26.8 percent had implemented an OFA fully and 45.9 percent had implemented an OFA partially. It is important to note that only 36 percent said that the OFA was conducted transparently and in line with predominantly objective criteria. However, 78 percent of the decision-makers surveyed are implementing measures derived from the OFA in a consistent manner.

The methodology

PwC conducted this three-part study in cooperation with the leading market research institute, Kantar, and with the Technical University of Darmstadt. The survey was sent to companies from Germany, Austria and Switzerland that have an annual turnover of more than 300 million euros. 157 decision-makers took part, including Board-level executives and employees from M&A and Strategy departments.

Contact us

Erik Hummitzsch

Mitglied der Geschäftsführung, Leiter Deal-Advisory und Co-Leiter Consulting Solutions, PwC Germany

Samy Walleyo

Partner, Leiter Industries, Leiter Deals Strategy and Operations, PwC Germany

Tel: +49 170 2064280