ECA Financial Advisory & ECA Coordination Practice

15 January, 2018

We coordinate and support the ECA financing process

In today’s project finance market, large-scale or complex projects will usually require a sponsor who can combine financing from a number of different sources and ECAs. PwC is in an excellent position to take over the role as ECA Financial Advisor or ECA Coordinator. We can advise a group of ECAs and coordinate their underwriting requirements.

Our approach

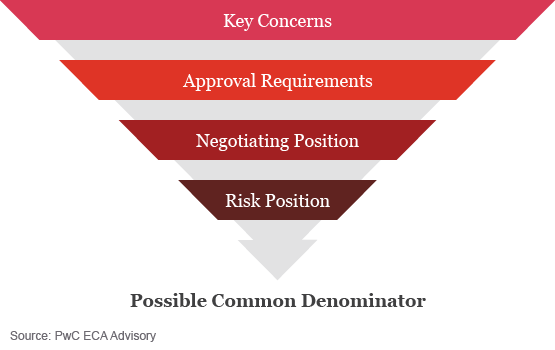

We will accompany the group of ECAs right from the start of the project – until they obtain their underwriting approvals. Our experience enables us to strike the appropriate balance between recognising the individual concerns and approval requirements of any ECA as well as facilitating discussion amongst all ECAs to find a common denominator regarding key risks. Throughout the due diligence and negotiations phase, we will support the ECAs with concise analysis and supporting information relevant to their individual needs.

Advisory services - as needed

We have over 30 years of experience in working with ECAs. That puts us in a very good position to perform our role as coordinator in a timely manner to meet the project deadlines. Throughout our assignment, ECAs will benefit from precise analysis and supporting information addressing their key concerns. Our worldwide brand reputation is a reliable basis for the ECAs’ underwriting decisions.

Our approach for ECA risk analysis of large capital projects

Benefit from our Know-how and expertise

We are highly experienced experts for ECAs on projects in a wide range of industry sectors and under both common law and civil law systems. Our team specialises in the most pre-eminent areas of global ECA-covered project financings. We have worked on some of the most important, innovative and complex projects around the world. Our team has substantial experience in analysing projects that combine different forms of financing involving multi-lateral, developmental and export credit institutions as well as Islamic funding, project bonds and borrowing base structures. We are familiar with traditional and innovative forms of project financings. Our team combines in-depth industry knowledge, market expertise, solutions and strategies.

Profit from our analysis approach and clear recommendations

Understanding, anticipating and satisfying ECAs individual needs is a priority for us. This commitment allows us to deliver an outstanding level of service. Every transaction presents unique demands - we work as part of the project team, taking a non-legalistic, solution-orientated approach focusing on delivering pragmatic solutions. We analyse the commercial and regulatory environment of each project, and understand the underlying business issues and risks. Our goal is to give clear recommendations and help finding commercially sound solutions.

Rely on our efficient process and coordination skills

These are the key features that make our approach unique:

- client focus

- multi-specialism

- process and coordination skills

We put the needs of our clients centre stage and focus on efficiency. We work constructively and coordinate with the other project participants to allocate risks appropriately. Our team members are multi-specialists, equipped to handle a broad range of both commercial and documentation related matters. Our deep knowledge of ECA decision processes and their due diligence requirements enables us to coordinate a group of ECAs in the best way possible.

Contact us