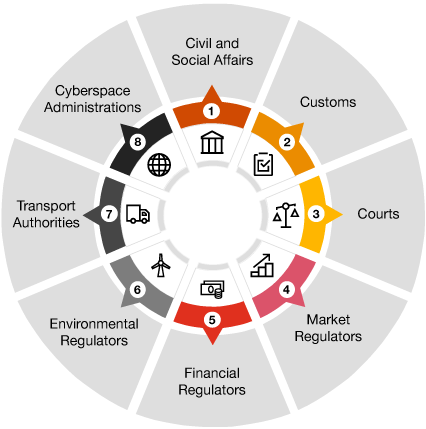

Relevant governmental institutions that may enforce compliance

Examples of potential consequences of non-compliance

- Targeted audits by governmental authorities (e.g. tax refund audits)

- Travel restrictions for company representatives

- Increased inspection rates for import and export cargo

- Temporary exclusion from public tenderings

- Delays in governmental approval processes