Regulatory update for China’s NEV market - PwC China Compass

30 November, 2020

China has been promoting the manufacture and use of new energy vehicles (NEVs) for some time. In response to coronavirus-related developments and changed market conditions, the government has now updated the regulations applying to this area of eco-friendly transport – to attract new investors and consumers, among other goals.

Foreign investment relaxed

Foreign investment in the Chinese market for new energy vehicles (NEVs) has been on a level playing field with domestic players since 2018. For example, Tesla Shanghai is wholly owned indirectly by Tesla US.

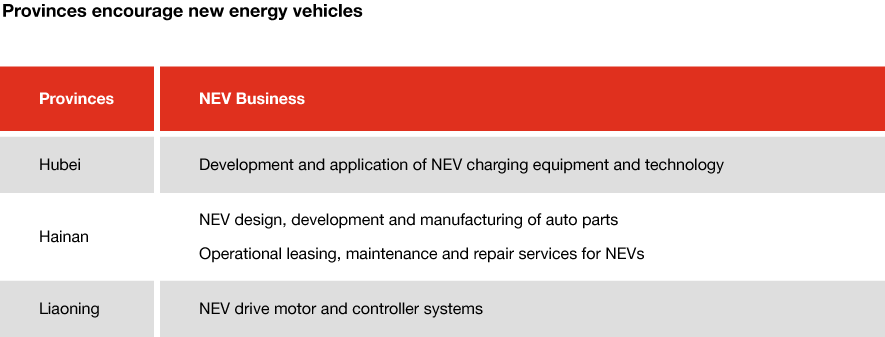

More and more Chinese provinces are eyeing NEV-related business as encouraged foreign investment and are offering such deals preferential treatment, including financial subsidies, cheaper land and potential tax holidays. For example, in the draft version of the Catalogue of Encouraged Foreign Investment (2020), the following provinces have specifically identified the activities on their wish lists:

Lower threshold for NEV entry

With a view to allowing more players into the NEV market, the Ministry of Industry and Information Technology (MIIT) recently revised the Regulations on Access Review for New-Energy Vehicle Manufacturers and Products (“NEV Access Regulation”, No. [2017] 39) effective September 1, 2020. The aim is to lower the starting threshold for NEV manufacturers.

The most prominent change is the removal of requirements for design and development capability, which means new NEV companies only need to meet the remaining criteria for production capacity, product conformity, after-sales service and safety assurance as the overall technical guarantee for NEV products.

At the same time, the production suspension period, which MIIT can use to “name and shame” offending NEV manufacturers, has been extended from 12 months under the old rules to 24 months under the new NEV Access Regulation, in line with the Measures for the Administration of On-road Vehicle Manufacturers.

China’s provinces are offering preferred treatment to NEV deals

Adjusted dual-credit policy

Since 2017, MIIT and other ministerial agencies have promulgated the Measure for the Parallel Administration of the Corporate Average Fuel Consumption and New Energy Vehicle Credits of Passenger Vehicle Enterprises (“dual-credit regime”). According to this measure, each vehicle manufacturer/importer above a certain scale is required to maintain NEV credits of more than zero. NEV credits can be earned by manufacturing or importing NEVs.

On June 15, 2020, MIIT, the Ministry of Finance (MOF), the Ministry of Commerce, and the PRC General Administration of Customs and QSIQ adjusted the methods for calculating credits for new energy passenger vehicles and set out the requirements for NEV credits from 2021 to 2023. The adjustments become effective on January 1, 2021.

Charging facility

Only centralized charging and battery replacement power stations are required to obtain construction permits from the relevant authorities. In the first half of 2020, several local authorities, such as those in Tianjin, Guangxi and Shenzhen, introduced local regulations and incentive policies for the construction and operation of charging infrastructure.

Subsidy and tax exemption

On April 23, 2020, MIIT, MOF, the Ministry of Science and Technology, and the National Development and Reform Commission issued the Circular on Improving the Subsidy Policy for the Promotion and Application of New Energy Vehicles, under which the original expiration date for subsidies for NEV purchasers will be extended by two years until the end of 2022. From 2020 to 2022, the subsidy will generally be reduced by 10%, 20% and 30% compared to the previous year, respectively, and the number of vehicles eligible for the subsidies will not exceed approximately two million each year.

Similarly, on April 16, 2020, MIIT, MOF and the State Taxation Administration issued the Announcement on Exemption Policy of Vehicle Purchase Tax for New Energy Vehicle, which extends the exemption of the vehicle purchase tax for NEVs to 2022.

Our Expert

Jing Wang

Tel: +86 10 8540-4630

Email

Conclusion

The NEV market remains vital for the Chinese government and for players in the automotive industry. To respond to recent developments and further promote policy objectives, the Chinese authorities have altered – and in some cases relaxed – requirements for businesses active in the NEV sector. Multinational companies are advised to enter the market from the right angle and with the right partners. VW, Daimler and Honda have all committed to investing in the sector as of the first half of 2020. NEV-related business opportunities in other sectors, including value-added telecommunications, smart vehicles, and connected/automated driving, are already visible in the pipeline.