From mega deals to mid caps: international investors acquire some 870 German firms in 2017

27 December, 2017

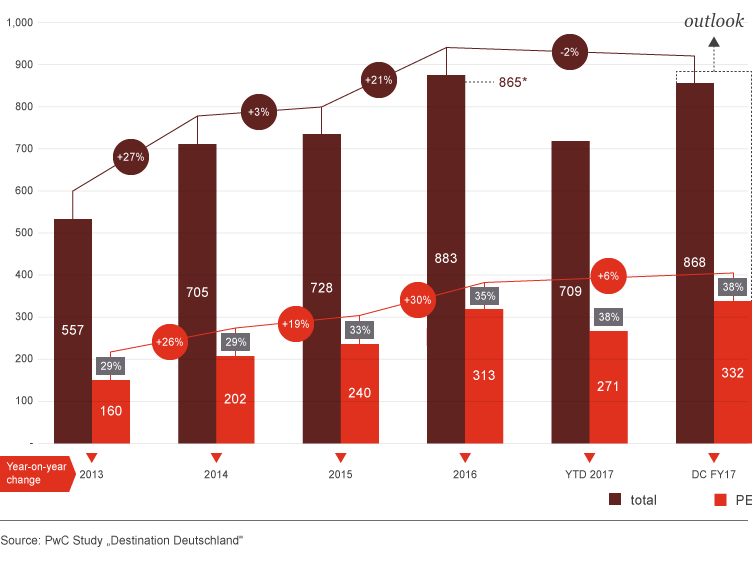

From Linde’s acquisition by its US-based competitor Praxair (EUR 40.5 billion), through Alstom’s EUR 8.2 billion purchase of Siemens’ rail business, to Finnish energy company Fortum’s bid for E.ON spin-off Uniper (EUR 8.1 billion), 2017 was the year of the mega deal on Germany’s M&A market. But international investors do not just have their sights set on major corporates – they are also continuing to eye mid caps. Analysis by PwC shows that by mid-November alone, a total of 709 businesses had already been acquired by international players. In view of the lively dealmaking in recent weeks, experts expect that number to rise significantly by the end of the year: “All told, we assume that international players will acquire roughly 870 German businesses this year,” said Steve Roberts, Head of Private Equity at PwC in Germany. That figure is only just shy of the record 883 deals seen last year.

Deal Activities since 2013

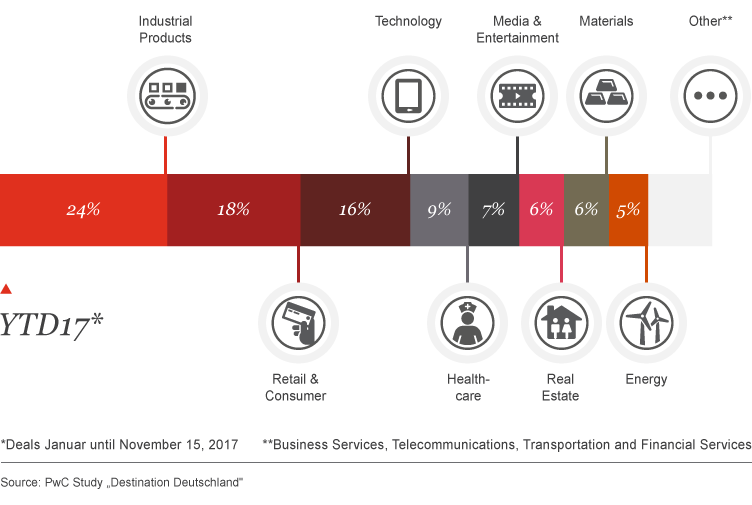

Investors from the United States were behind 158 of the deals announced by mid-November. In second place thanks to the strong franc was Switzerland (80 deals), while UK investors seem to have shaken off the initial shock of Brexit to advance from fifth to third in the ranking (72 deals). Buyers from France were behind 55 deals, while China (47 deals including Hong Kong) was tailed by two further eurozone states, the Netherlands (38) and Austria (29). Broken down by sector, “industrial production” (24%) retained its leading position from 2016, followed by “commerce & consumer goods” (18%), “technology” (16%), “healthcare” (9%) and “media & entertainment” (7%).

M&A-Deals by heritage of the Private Equity-Investor: Number of announced transactions

The share of deals originated by private equity firms remained high. While in previous years three in ten purchasers had been financial investors, this figure has since risen to almost four in ten. As the year draws to a close, the biggest deal to date was Bain & Cinven’s EUR 4.6 billion acquisition of pharmaceuticals company Stada via a joint investment vehicle. The top ten includes a further three PE deals – the acquisition of energy management group Ista by a financial investor from Hong Kong, the sale of packing supply specialist Mauser in the USA, and Global Infrastructure Partners’ investment in the Borkum Riffgrund offshore wind farm.

Distribution of deals by branches measured by the number of closed deals

Contact us