Your expert for questions

Steve Roberts

Partner, Private Equity Leader, PwC Germany

Tel: +49 69 9585-1950

Email

PwC analyses the profitability of PE investments in German IT companies

Private equity investments in the German IT sector steadily increased over the past twenty years, reaching a historical high of 9.5 billion euros in 2019. How profitable are these investments for private equity firms and what strategies are pursued by the most successful PE investors? Our newest study “Superior PE returns with investments in German IT assets” provides answers to these questions:

Overview of the study

Market outlook remains positive despite of an impressive growth over the last 20 years

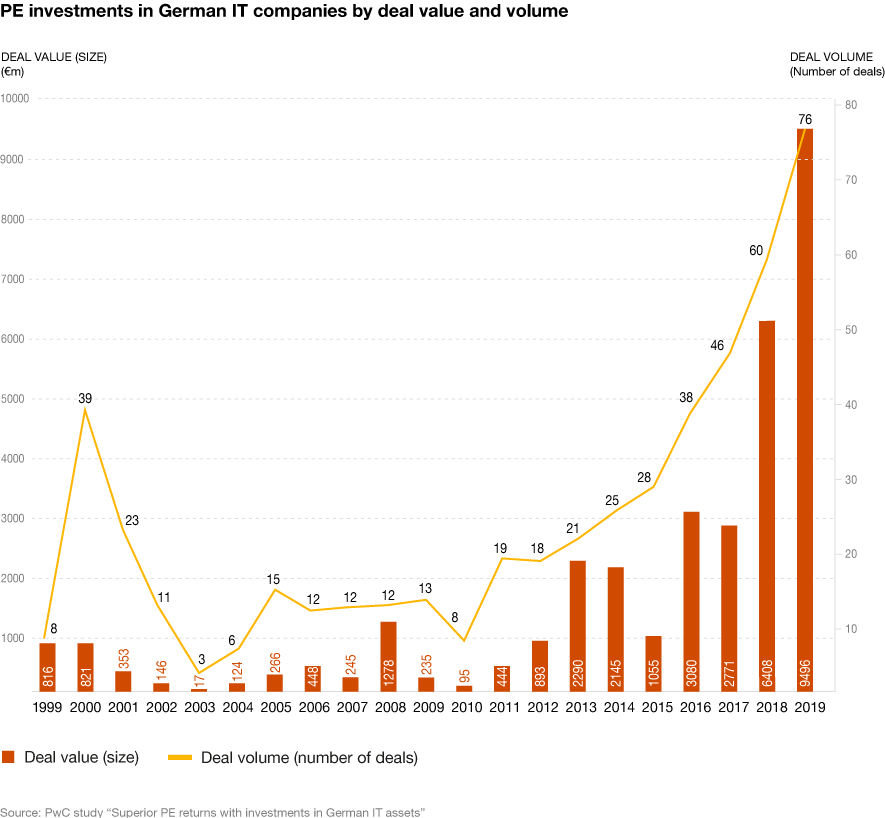

Private equity investments in the German IT sector climbed from 6.4 billion euros in the previous year to estimated 9.5 billion euros in 2019 (+48%). The number of deals with participation of PE investors increased year-to-year from 60 to 76 deals. The average transaction value increased from 107 million euros to 125 million euros as compared to the previous year.

The market value has been significantly pushed up by three mega deals: the 2.9 billion euros acquisition of the online marketplace Autoscout24 by Hellman & Friedman and the 2 billion euros buyout of the software development and IT service company P&I Personal & Informatik AG by HG in December 2019, and the buyout of the network operator Inexio by EQT for 1 billion euros in September 2019. In contrast, 2018 has seen only two comparable mega deals, the 2.7 billion euros buyout of the open source software company SUSE by Swedish EQT Partners and General Atlantic’s 813 million euro investment in the NuCom Group, the commercial business of ProSiebenSat.1.

“The trend is towards larger deals, not least because of higher valuations of IT assets”, says Steve Roberts, Private Equity Leader at PwC Germany. “The current development indicates that the market will continue to grow at least in the short term. We expect to see more exits, but also further PE investments in growing IT sectors, such as artificial intelligence, data management and analytics.”

“Private equity investments in German IT market will increase in artificial intelligence, data management and data analytics segments.”

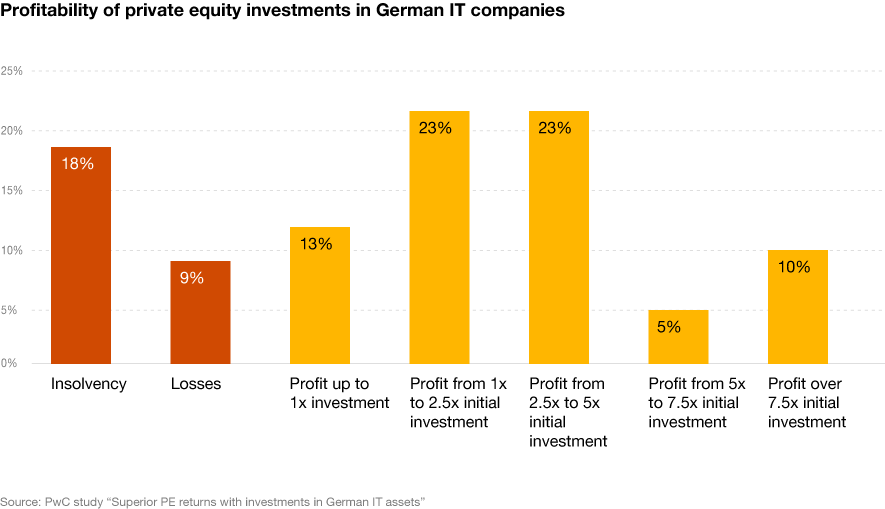

Investments in German IT companies are highly profitable but risky

Private equity investors have earned significant returns of on average 3.5x initial investments in German IT companies, reaching in each tenth case money multiples of over 7.5x. The risks are high – more than a quarter of all investments results in losses. “Considering high risks, new investments in the German IT sector should be evaluated under special consideration of the target firm’s internal capabilities and its potential for long-term profitable growth”, recommends Steve Roberts. “The selection process of companies with unique software technologies and future-proof business models requires an in-depth knowledge of the German and global technology markets.” “Also, the faster a clear milestone plan for the company’s development from Day 1 to the exit can be developed, the more target-oriented is the management of the transformation process, and the sooner a performance breakthrough can become reality.”

“The selection process of IT companies with unique software solutions and future-proof business models requires an in-depth expert knowledge of the German and global technology markets. Also, the faster a milestone plan from Day 1 to the exit can be developed, the sooner a performance breakthrough can become reality.”

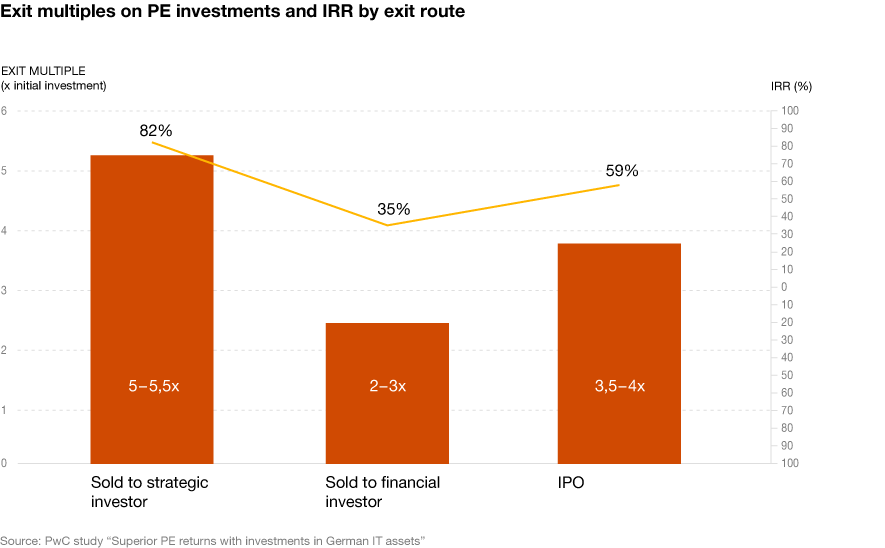

Profitability analysis of the most successful PE deals shows that an exit strategy should be designed at an early stage to enter strategic alliances, make add-on acquisitions, identify the preferred exit route and potential buyers, and prepare disposals. For example, historical data indicate that disposals to strategic investors are with 5x to 5.5x money multiples far more profitable than disposals to other financial investors or IPOs. “Strategic buyers are ready to pay higher premiums for growing companies with mature business models that are complementary to their core businesses,” explains Steve Roberts. “Acquisitions of highly innovative companies help to avoid R&D expenses and realise synergies.” Obviously, this fact has been recognised by many PE investors – sales to strategic companies provide the highest proportion of exits of the last 20 years (62%) versus just 24% from less profitable disposals to other financial with average money multiples of 2x to 3x initial investment. PE-backed IPOs, comparably time-consuming and associated with complex legal and regulatory requirements, have delivered around 3.5x to 4x returns or even less – depending on the calculation methodology – and have been less common in recent years.

“Strategic buyers are ready to pay higher premiums for fast growing companies with mature business models that are complementary to their core businesses. Acquisitions of highly innovative companies help to avoid R&D expenses and realise synergies.”

Competition is running high – top players come from the UK, the USA and Scandinavia

Global private equity investors play a significant role on the German IT market: The top PE players by deal value are the UK, the US and Scandinavian PE houses EQT, Permira, Hg Capital, General Atlantic, and Warburg Pincus. German PE investors Deutsche Private Equity, Emeram and Capiton follow shortly behind. Leading PE investors usually hold controlling stakes of three to four German IT companies, whereas other PE houses are invested in one to two assets.

“We expect further PE investments in the German technology sector in the next few years, specifically in the areas of artificial intelligence, data management and analytics.”

Methodology

The study is based on an analysis of IT investments over €5m in Germany with participation of private equity investorsin the period from September 1999 to September 2019. Sources: Mergermarket, Unquote, PwC analysis.