Board Services – Our services in detail

With our Board Services, we support you in your diverse Supervisory Board tasks. Benefit from our services in the areas of evaluation, corporate governance, remuneration, training, Board office support and ESG workshops for Corporate secretaries and Board offices.

Evaluation

Self-assessments according to D.12 GCGC and valuations according to section 25d KWG

The regular evaluation of the activities of the Supervisory Board and its Committees is recommended by the German Corporate Governance Code (recommendation D.12). The Code leaves much scope for the Supervisory Board to implement this recommendation.

We design this scope together with you. Whether structured personal interviews, surveys of Supervisory Board members using a questionnaire, a user-friendly tool or moderated plenary discussions - we will find a suitable solution for every Supervisory Board. Because of our in-depth corporate governance expertise, we are very familiar with the framework conditions of the Supervisory Board and the resulting challenges. We support self-assessments in all company sizes regularly and with a high level of customer satisfaction. And that’s what sets us apart:

Target group-oriented concept

- We are in close contact with Supervisory Board members of many companies of various sizes and ownership structures.

- We are familiar with the central issues of the Supervisory Board and know what it attaches importance to.

- Our concept enables a regular, smooth repetition of the self-assessment.

Benefit-oriented implementation

- We do not see the self-assessment as a legality audit.

- For us, it is an instrument that qualitatively enhances the work of the Supervisory Board and its cooperation with the Management Board.

Clear result

- Our concise, meaningful reporting enables the Supervisory Board to implement recommendations directly.

- It objectively classifies the degree and intensity of any criticism without ignoring important individual opinions.

For credit institutions, Section 25d (11) of the German Banking Act (KWG) stipulates that the Supervisory Board must assess its structure, size, composition, and performance on an annual basis. The management must also be evaluated in the same way.

To this end, the principles and techniques developed for self-assessments according to GCGC can be applied. It goes without saying that we take into account the regulatory requirements and special features of credit institutions, for example with regard to the individual assessment of the knowledge, skills and experience of board members.

For us, it goes without saying that our evaluation concept also supports the supervisory body in meeting the expectations of banking supervision. You benefit from our many years of experience in supporting the supervisory bodies of credit institutions of all sizes and ownership structures as well as our exchange with (European) supervisors.

Corporate Governance

Economic and regulatory issues, liability prevention and expert opinions on directors’ and officers’ liability

We advise you on all economic and regulatory issues relating to corporate governance. Whether implementing new legal requirements, applying the German Corporate Governance Code, further developing the Supervisory Board’s work, or clarifying individual questions of doubt - we support you with our in-depth corporate governance expertise. Targeted. Reliable. Practical.

Our range of services covers companies of all industries, sizes, and ownership structures. It includes, for example:

- Implementation of new governance structures

- IPO and DCGK readiness checks

- Creation of a competence profile/qualification matrix for the Supervisory Board

- Implementation of suitability policies at banks according to the BaFin guidance notices and/or the ESMA/EBA guidelines

- Preparation and revision of rules of procedure

- Optimization of Supervisory Board reporting

- Supporting the internal audit in corporate governance investigations

- Preparation and optimization of external corporate governance reporting

Due to the increased requirements related to the work of the Supervisory Board, liability issues are playing an increasingly important role. We provide you with comprehensive support both with regard to your own liability situation and with regard to any claims against members of the Management Board. This includes meaningful liability prevention as well as the expert examination of possible claims and their enforceability.

Remuneration

Structuring and benchmarking of Management Board and Supervisory Board remuneration

Supervisory Board members face numerous challenges in determining the remuneration of the Management Board. The overriding goal is to create meaningful incentives geared to sustainable strategic success.

At the same time, extensive regulatory requirements of the German Stock Corporation Act, the German Corporate Governance Code, and individual special laws (such as the German Banking Act and the German Institutional Compensation Ordinance) must be met. The increased expectations of investors regarding the structure and traceability of Management Board compensation must also be taken into account.

We support you in this task with our comprehensive knowledge of best practices in the market as well as regulatory requirements - holistically. In addition to classic remuneration and governance issues, PwC experts can also shed light on tax and accounting issues arising from the remuneration of the Management Board.

The Supervisory Board must also ensure that the amount of the Management Board remuneration is appropriate. We assist you in this process by preparing appropriateness reports and benchmarking, in which not only the amount and structure of the remuneration of the Management Board are reviewed for compliance with market standards, but also the criteria and process of determining remuneration are subjected to an objective examination.

Of course, we are happy to support you to the same extent in all questions concerning the remuneration of the Supervisory Board.

Trainings

Individual introduction and training seminars for Supervisory Board members and whole bodies

Regular training is part of the responsible work of the Supervisory Board. The Government Commission “German Corporate Governance Code” also stresses this and recommends that companies support their Supervisory Board members in this.

In Section 25d of the German Banking Act, credit institutions are required by law to employ appropriate personnel and financial resources in order to make it easier for members of the administrative or supervisory body to take up their duties and to enable them to undergo the training required to maintain the necessary expertise.

We support you in your training and conduct individual workshops and seminars on topics relevant to the Supervisory Board – in person or online. In doing so, we will fully cater to your wishes and needs.

- Are you about to take on a new mandate or are you thinking about it? We provide you with an overview in basic training courses on Supervisory Board and Committee work.

- Your Committee or individual members want to stay up to date or want to specialize in a specific topic? We inform you about current regulatory steps, the latest best practices in the field of Supervisory Board work and provide you with in-depth accounting updates.

- Whether as an exclusive individual discussion or an event for the entire board - we have the tailor-made solution for you. Practical relevance is our top priority.

Board Office Support

Relief for your Board Organisation through our qualified experts

As regulatory requirements for Supervisory Boards increase, so does the need for support and thus the workload for Corporate Secretaries and the Board Office. We can relieve you of this burden, either in the short term for temporary staff shortage or in the long term.

Our expert advisors with in-depth corporate governance expertise will support you in all Board Office tasks, in particular:

- Preparation and follow-up of Board and Committee meetings, including the preparation of templates and taking the meeting minutes.

- Support in corporate governance reporting, e.g., in the context of preparing annual financial statements or issuing declarations of conformity with the German Corporate Governance Code

- Corporate governance processes, such as querying mandates and conflicts of interest of Board Members

In addition, we are happy to support you in “upskilling”: for example, if your company falls within the scope of the application of new regulatory requirements, but you do not have the capacity to work through them. In this case, we will do it for you and provide you with an individual overview so that you can keep an eye on what is most important. For example, on the subject of ESG.

ESG@Boardroom

The ESG Workshop for Corporate Secretaries and the Board Office

The increasing regulations in the field of ESG have an impact on almost every area of work of the Supervisory Board and thus also of the Board Office. In order to be able to support the Board in the best possible way with ESG challenges that arise, it is essential for the Board Office to maintain an overview of all relevant requirements.

We have inventoried and categorised ESG-related requirements and prioritised them from the perspective of the Board Office. In our workshop, we will inform you about the concrete implications and work with you to identify recommendations for action from your Board’s perspective.

What you can expect:

- Individual ESG requirements prepared from the perspective of the Board Office

- Individual tailoring of your workshop agenda and any hot topics

- On-site workshop or virtual/hybrid format

- Categorised and prioritised development of ESG action items

- Development of starting points for your ESG roadmap

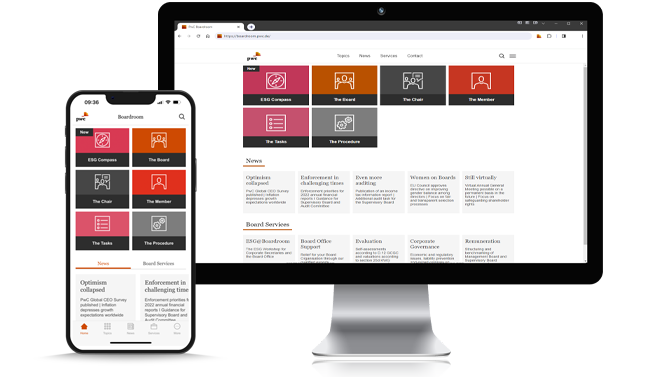

PwC Boardroom App

The free app for Supervisory Board members offers practical knowledge and tips for Supervisory Board tasks. Via push-notifications we inform you about relevant news regarding Supervisory Board tasks.

You can download the app on your smartphone or your tablet, or you can access the WebApp directly through your browser.

Contact us