Brexit and Financial Services

08 February, 2019

Pre-Brexit Business Model

Based on the common pre-brexit business model, the non-German international financial institutions such as banks, asset managers and insurance companies have often serviced their German clients via a German branch of the UK legal entity using the EU-Passporting privilege. The German branch often had a limited function and was usually responsible for product distribution and client relationship management. Most back and middle office functions were executed from the head office in the UK and charged to the German branch. Moreover, most risks and significant people functions were located in the head office. The trades and clients were booked in the UK.

Brexit Restructuring

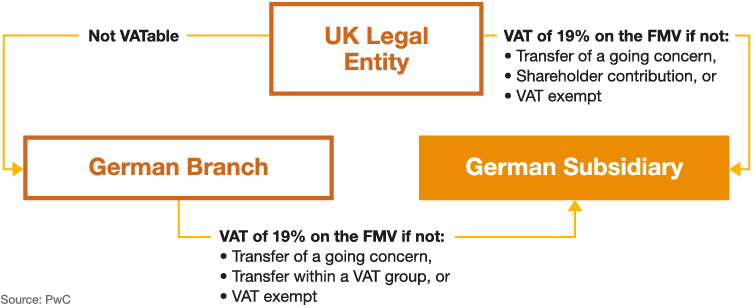

Because the Brexit date is getting closer, the financial institutions are now under pressure to change their business model. Most of them have already implemented a German subsidiary and filed BaFin applications for a German license. To satisfy the regulatory requirements, the financial institutions will need to bring additional substance into its German subsidiary and will move certain trading activities, assets, capital and people functions. This transfer might cause a significant non-recoverable VAT exposure.

Supplies of goods or services against consideration rendered by an entrepreneur for the purpose of his business in Germany are subject to German VAT.

The transfer of intangible assets such as receivables, client base, know-how or goodwill from a legal entity in the UK to its German subsidiary should generally be considered as a service which is taxable in Germany as both the UK legal entity and its German subsidiary should qualify as entrepreneurs for VAT purposes. The transfer of some assets, such as receivables, should be exempt from VAT. However, most transfers might suffer a 19% VAT impact. The taxable basis for VAT will be the consideration for the transfer of the services. If no consideration can be determined, the taxable basis will be the fair market value (FMV) of the transferred assets.

VAT Implications

This VAT impact can, however, be avoided by a proper structuring of the transfer. VAT would for example not be due if the transfer qualifies as a transfer of a going concern or if the transfer takes place within one legal entity or within a VAT group. Furthermore, services rendered by the UK legal entity to its German subsidiary should not be subject to German VAT as far as they qualify as a shareholder contribution base on the German corporate law.

Contact us

Partner, Praxisgruppenleiter Umsatzsteuer Financial Services, PwC Germany

Tel: +49 151 61358384