The Brexit Challenges for Financial Institutions

22 January, 2019

Relocation of existing businesses from UK to Germany – Tax disadvantage of up to 24 percent vs. tax capacity of up to 14 percent

The only certainty about Brexit is that it remains politically and economically highly uncertain. It brings challenges for the entire organizations and pushes in particular the international financial institutions such as banks, insurances and asset managers to material structural adjustments. In order to fulfill the regulatory requirements set out by the ECB and BaFin, the incoming Banks are required to bring additional substance into its German entities.

The transfer can include certain assets and liabilities or even entire business or service lines (existing business). Some banks have already started to inform their EU-27 clients that in the future they will be contracted out of the German subsidiary rather than from the UK entity. For capital, funding and operational efficiency reasons some clients will demand a transfer of their existing contractual relationships to the German subsidiary.

Main legal considerations on a transfer of the existing business into Germany

The transfer of the existing business will come with:

- additional operational burdens,

- additional capital requirements,

- potential funding issues,

- potential hedge accounting issues,

- tax and legal issues.

From the legal perspective, two major points are to be considered. Firstly, the transfer of the existing business must not contradict the German capital maintenance rules. This issue is manageable if the transferred assets and liabilities in total have a positive value. However, more difficult is here the question of the validity of the legal and contractual bases of the transferred products and clients (individual and framework contracts, licenses, internal and external policies). Under certain circumstances, the transfer of the existing business and relationships to the clients into Germany will lead to an expensive and time-consuming repapering work. In particular, the client facing contracts must be amended to the new legal environment.

Tax issues to be considered

The two major topics from the German tax perspective in relation to the transfer of the existing business to Germany are the correct classification/reclassification of the assets (e.g. qualification as debt or equity, tax burden, amortization terms, loss ring-fencing etc.) and the determination of the value at which the assets and liabilities will be recorded in the German tax balance sheets. Furthermore, the transfer pricing policies must be verified and, if necessary, adjusted.

As in most cases, the transferred assets and liabilities should take place at fair market value and therefore lead to an exit taxation of built-in gains in UK at a corporate income tax rate of 19 percent. On the other hand, the transferred assets and liabilities will be recorded in the German tax balance sheets at fair market value and, therefore, reduce the future German tax basis by depreciation or, in case of a disposal, by consideration as acquisition costs. The German tax effect would be up to 33 percent (corporate income and trade tax). The transfer may therefore lead to a group wide tax advantage of 14 percent. Although the basis for the exit taxation in the UK and the taxation in Germany should be the fair market value of the transferred existing business, the UK and German tax authorities may ask for different valuation methodologies for determination of the fair market value, which might lead to a lower or higher tax capacity in Germany.

Beside to the right choice of the valuation methodology, an adjustment of the future transfer pricing policy needs to be taken into consideration. In particular, the future costs directly or indirectly connected to the transferred assets must be allocated correctly to avoid substantial tax leakage. The adverse tax effects can be demonstrated on the following example:

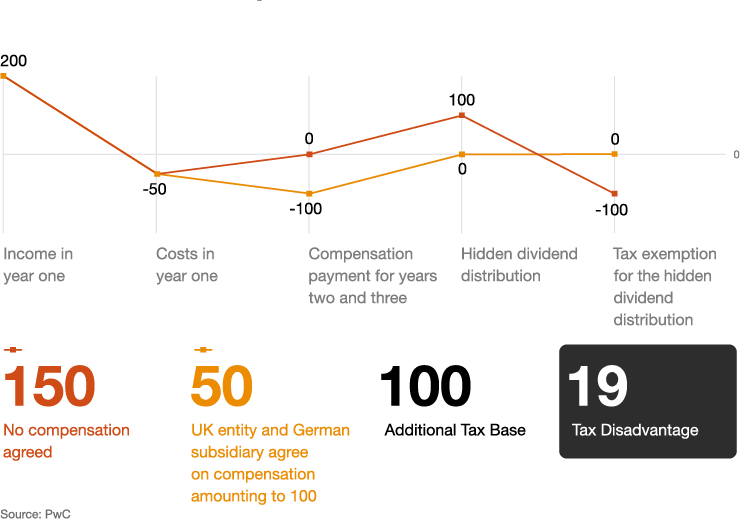

Facts: An UK entity transfers a three-years-instrument of a client to German subsidiary in the year two. In the year one, UK entity has received a commission payment of € 200. All risks and opportunities on the value development of the instrument are outsourced to a third party. The servicing of the instrument causes net costs/expenses in the year two and three of € 50 each year.

Tax consequences at the level of UK entity

Tax consequences at the level of German subsidiary

The future expenses in connection to the servicing of the transferred instrument should not have an effect on its valuation. However, under the arms-length principles, the German subsidiary would ask for a compensation of the future costs/expenses.

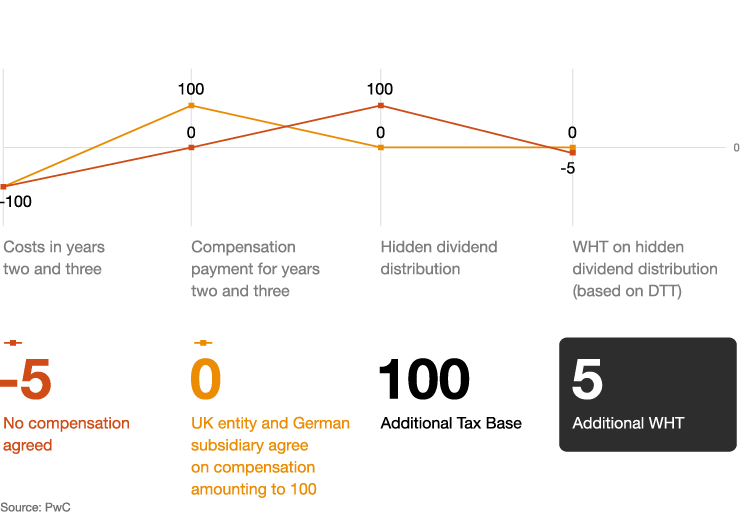

In case no compensation is agreed between UK entity and the German subsidiary, the costs of € 100 will be considered as a hidden dividend distribution in Germany and lead to a respective increase of the German tax base.

In addition, post Brexit the hidden distribution should trigger German withholding tax of 5 percent. In the UK the hidden profit distribution will be treated as tax neutral dividend income. Compared to the alternative where a compensation for the servicing costs is agreed and the costs are correctly allocated to the UK entity, there is a higher taxation burden in the UK of 19 percent on € 100. This leads together with the German withholding tax to a potential tax leakage of 24 percent.

In a nutshell, the transfer of an existing business from the UK to Germany can bring group wide a tax advantage of up to 14 percent or in the worst-case scenario a tax disadvantage of up to 24 percent. We recommend our clients to analyze the legal and tax consequences in detail before executing the relocation of the existing business to Germany. Brexit is a disruptive process and all market players continue to face great challenges. However, properly planned and executed restructuring measures should lead to new opportunities and create new tax capacity for the financial institutions.

Contact us

Contact us