En route to the digital future

Digitalisation is transforming companies and other organisations more fundamentally than the business world has ever seen. As companies are transformed, so are their finance and accounting functions, and in turn, their financial statement audits.

PwC conducted the first survey in digitalisation of financial statement audits back in 2016, with 98 companies. It was very well received, which, along with the relevance digitalisation has for participants and for PwC as auditors, inspired us to conduct this second survey. We decided to include some graphs comparing key findings of the current survey with the responses from 2016 to give more insights into overall trends.

WP StB Prof. Dr. Rüdiger Loitz, COO Assurance and Leader Capital Markets & Accounting Advisory Services

What will the financial statement audits of the future look like?

We wanted to find out exactly and hence, we split this question into more than detailed 40 questions, asking officers from finance and accounting departments at 76 large and medium-sized companies based in Germany. Here are the key findings: Digitalisation has arrived in finance and accounting, albeit later and more hesitantly than in other departments. The extent to which technology is used in auditing is still relatively low. However, there is an increasing awareness of the necessity of opening up finance functions to new technologies.

1. New technologies for a wide range of activities

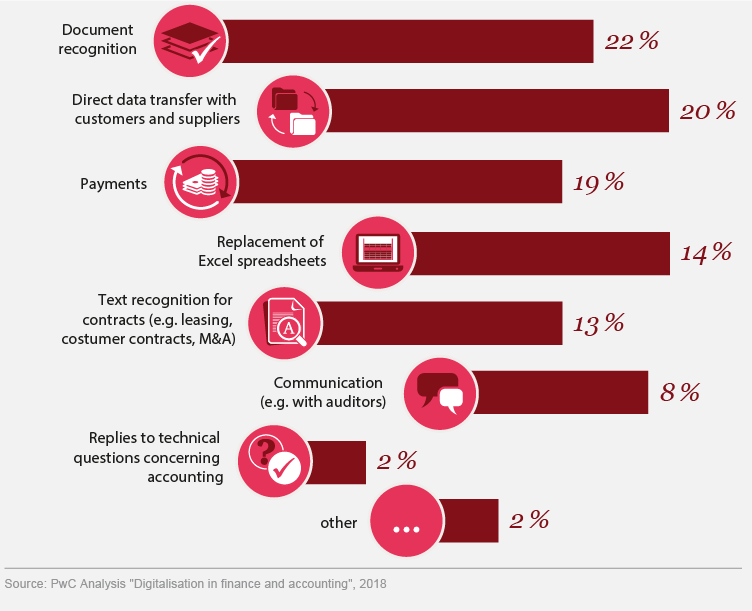

The surveyed companies would like to make use of new technologies including AI, software robots (robotics) and blockchain. They are currently looking mainly at document recognition (22 percent), direct data processing with customers and suppliers (20 percent) and payment transfers (19 percent). New technologies continue to play relative minor roles in analysing business processes, reporting and documentation.

2. AI increasingly relevant, robotics and blockchain still at early stage

Although AI is still in the early stages of development, it is already being used by 18 percent of the companies. As in 2016, over half of the surveyed companies are still not using AI. One reason is the difficulty of evaluating unstructured data and mass data systematically using AI. Moreover, 13 percent of the surveyed companies are utilizing software robots and 22 percent intend to do it in the future. Only eight percent of the surveyed companies are currently making use of blockchain technology.

3. Fewer concerns about staff reductions

When it comes to technology-related staff reductions, only 19 percent of the surveyed decision-makers think that this will be the case for their finance and accounting departments. In contrast, the response rate in 2016 amounted to 27 percent.

4. The end of the Excel era is bringing new information gains

The survey clearly shows that the Excel era is swiftly coming to an end in finance and financial statement auditing. PwC has already developed appropriate tools, such as GL.ai (General Ledger artificial intelligence), which uses algorithms in financial statement audits to save time when analysing large data sets and identifying areas of risk.

"The principles of accounting remain the same, even in the digital age. However, technological trends have the potential to transform accounting. Digital technologies can process data far more quickly and reliably than human beings can. They provide an opportunity to fundamentally redesign many financial procedures and generate added value."