Market Expertise

15 January, 2018

Know the market risk

Before ECAs take a decision on projects, they have to evaluate what can go wrong along the way. The most important risks they have to watch out for are market risks, in particular pricing and volume risks. We can support ECAs in identifying such risks, assessing them and developing tailor-made financial solutions to mitigate the impact on projects.

Our highly specialized commercial and market consultants understand the local and global markets. We can provide ECAs with a 360° view on the market risk profile of project and structured financings.

Our approach

PwC’s market experts use special tools to validate forecasts and economic assumptions. We apply scenario analysis to simulate the uncertainty of prices and demand forecasts. For instance, by using Monte Carlo simulations our experts are able to increase the reliability of pricing forecasts significantly. We find individual financial solutions for term sheets and financing documentations protecting the project from market risks.

We provide market guidance in the following areas:

- selecting independent market consultants

- defining the relevant “scope of work”

- implementing and coordinating work streams

- analysing and evaluating market forecasts and assumptions

- market analysis

- reviewing third party market due diligence reports

- identifying key market issues and risks

- coordinating ECA’s Q&A process

- evaluating risks and mitigation approaches

- analysing financial model market inputs in depth

- defining input parameter for sensitivity analysis

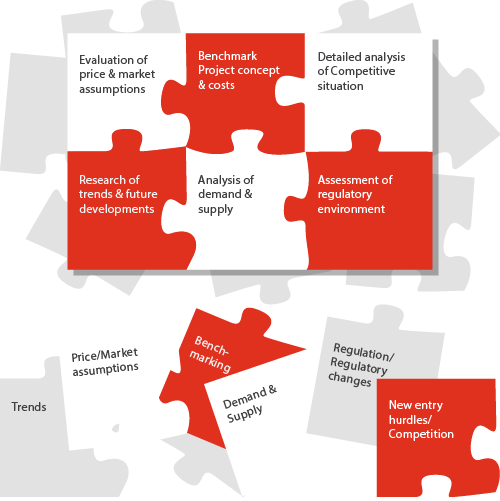

The PwC ECA Advisory Team supports ECAs in all stages of the project. We provide a 360° view on the market risks of the project by putting together the puzzle pieces.

Contact us