Case Study: Financial Forecasting with Forecast Plus

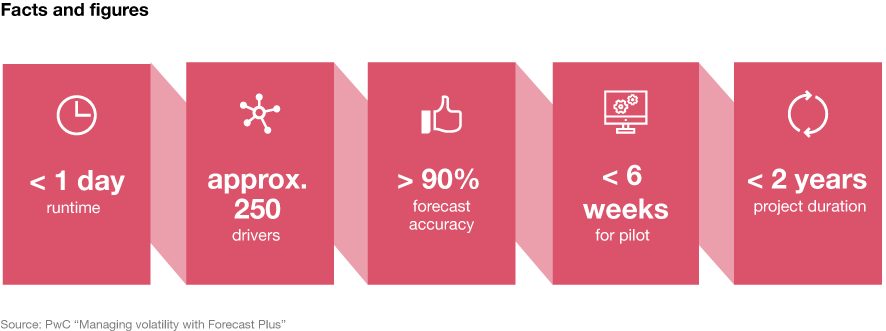

The situation/challenge: the company was looking for a promising way into the transformation of forecasts for key financial figures. The first step was to increase the reliability of revenue forecasts for different business areas and levels in the hierarchy. The methodology used in existing manual forecasts and statistical modelling methods varied depending on the business field. As well as delivering inaccurate forecasts, both of these approaches were very time-consuming.

In addition, no satisfactory solution had been found for integrating external influencing factors and indicators to provide an additional data level. The challenge was therefore to exploit untapped potential through an AI-based, standardised and automated forecast solution and to lay the groundwork for effective, data-driven decision-making based on predictive analytics.

Our approach: from analysis to automation

Our approach is based on a five-phase model. For our client, phase 1 started with a pilot project for predictions relating to selected regions and business areas. We drew on relevant internal and external influencing factors as much as possible to form the basis of subsequent steps. These factors were analysed in great depth and used for initial forecasts, which also included specially prepared historic data.

The subsequent quality assessment showed that we were on the right track: the accuracy of the revenue forecasts was significantly increased for most KPIs compared with previous manual forecasts.

The aim of phase 2 was to identify automated drivers and models. To do this, the pilot was expanded to include other regions and business areas. Our team then identified clusters of valuable internal and external influencing factors and integrated them into the models used. At the same time, we expanded our database with additional external data sources and discussed other possible influencing factors with relevant stakeholders.

The focus of phase 3 was on optimising the accuracy of the forecasts. To do this, we developed highly customised models based on the findings to date. The methods were applied at all essential levels in order to provide detailed reports on results, findings and forecasts for the entire business hierarchy.

You may also find interesting

Managing volatility with Forecast Plus

The finale: business integration and upskilling

The project ended with phases 4 and 5. The first key task was to integrate the models and forecast methods developed into the business in order to provide automated revenue forecasts for all markets, regions, products and business levels. The transformation of financial forecasting also brought with it new profiles for managers and staff. As such, the final step was to conduct workshops for upskilling the employees together with the client in order to ensure that the solution provided could be used immediately and to good effect in daily operations and to generally explain the differences between these forecasts and manual reports.

The added value was clear at the end of the project:

Customised models resulted in more accurate revenue forecasts. A simple, more scalable approach than with manual forecasts was created, and further training and assistance – from Data Scientists to finance function staff – were provided.

“To improve our revenue forecast and to fuel our digital business development, we needed a clear understanding of external factors driving our market. By joining forces with PwC’s Forecast Plus team, we've got it all: A highly savvy, flexible and 100% reliable team translating our complex requests into an improved, encompassing forecasting quality driven by AI. We are more than satisfied with the outcome - and our journey will continue!”

Sr. finance analyst, FP&A of a German high-tech photonics company, 2021Contact us