Only with truly data-driven decision making can companies move confidently into the future.

Future of Steering

Planning is a long way from reality

Whether you’re a big corporation or a smaller company, making forward-looking decisions based on facts and data is becoming more and more difficult. This can have serious consequences: management representatives are increasingly having to revise revenue or profits downwards compared to earlier expectations and predictions – which causes negative consequences for the company value.

Stock market data from the last 20 years show that downward revisions to business results to an average loss of enterprise value of 158 million euros loss in its value.

Closing the gap in expectations

Companies that succeed in bridging the gap between performance of the finance function and the expectations of its stakeholders therefore have evident advantages. CFO office, corporate steering plays a crucial role in closing this gap: using data-based facts, it can play a significant part in answering key industry-specific questions. Key insights gained using state-of-the-art digital technology – especially AI and machine learning – are more useful for CFOs than ever before.

This means that corporate management of the future is directly linked to the finance function’s overarching task: namely, to enable the best possible decisions. Purely relying on past data and financial indicators is no longer adequate for predicting and controlling future company performance.

“Above all, corporate management means taking suitable measures to react as necessary to the internal situation and external factors, and ideally having an idea of which direction the company needs to take in the near future. A majority of today’s reports only show us outdated data which are used as the basis for limited financial planning that bears no relation to the actual drivers.”

Getting ahead of the game

We are industry experts, mathematicians, data scientists, economists, econometricians and predictive gurus. Our combined expertise allows us to achieve predictive excellence, far above the standards of simple forecasting tools.

Targeted collection of data to help understand current problems is now more crucial to business success than ever before. The increasing globalisation, international linking of value chains and markets, the growing number of political trouble spots, and constant crises are leading to high volatility in many markets and strong heterogeneity between industries. This increase in uncertainty makes corporate planning and steering more difficult. One way to confront this is to use leading indicators. Early assessments allow potential risks such as decreases in demand to be identified in good time, enabling companies to avoid overstocking and address markets differently.

“Early warning systems, which aggregate information from various leading indicators, can create forecasts for selected countries and industries, allowing the anticipation of developments over the next three to six months. Thus, companies can reassess their strategic outlook. Projections for specific sectors allow us to provide accurate early warnings for individual lines of business at an early stage, which in turn enables efficient corporate steering in those lines of business.”

Dr. Frauke Schleer-van Gellecom,Senior Manager and predictive excellence expert at PwC GermanyFurther reading

Interview on early warning systems (German)

Holistic corporate steering

Successful companies use their corporate management strategy to ensure that their business decisions are directly linked to their market performance. They do this by:

- Using internal, external, financial and non-financial information

- Developing flexible scenario planning

- Focusing on their CFO agenda

- Using a single source of truth, made possible by standardised, integrated, real-time data

Our services for corporate management

- Structure key business questions with our industry-specific KPI framework

- Predictive excellence platform: click and predict

- Integrated planning and simulation

- Intelligent reporting

Structure key business questions with our industry-specific KPI framework

Having the right data in an aggregated format is an essential prerequisite for any further analysis, and for reporting and management. By analysing this data based on specific KPIs, companies can identify whether they are meeting their goals; and, if so, how effectively. Our industry-specific KPI framework forms a structure for this analysis, including all relevant KPIs and their respective dependencies.

Our framework takes your corporate strategy as the starting point and uses it to derive a series of key business questions (KBQs). These KBQs define the relevant KPIs to allow for fact-based answers to the company’s key questions. The KPI framework reflects the relationships between the KPIs, and uses both internal and external information. This enables your company to gain a holistic understanding of all relevant factors influencing your business.

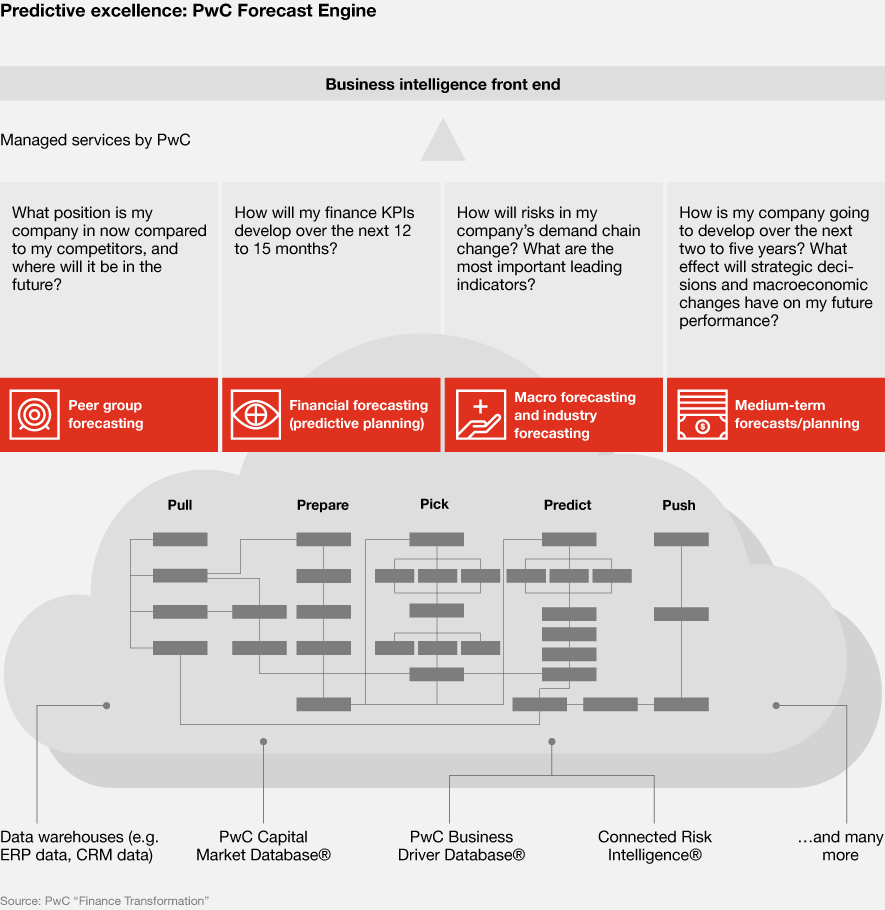

Predictive excellence platform: click and predict

Data-driven forecasting technologies that are based on AI and machine learning, offer huge benefits for your company.

Modern tools – such as our Forecast Engine, developed in-house – provide an objective, fact-based foundation for decision-making and corporate steering. Analysing large quantities of data enables changes in markets to be identified early. Precise, tool-based projections minimise unexpected variations, increase efficiency, free up resources, and allow corporate decisions to be better planned and made with greater certainty. This high level of automation allows forecasts to be produced and the push of a button, while employees can focus on generating valuable insights in their role as business partners. Specific simulations within the forecasting horizon can provide information about drivers and their respective relevance.

High-quality forecasts also capital market communication. Their integration into your financial planning process can prevent ad hoc profit warnings and thus increase trust in your company.

Business case: The introduction of a data-based forecasting tool can generate a net benefit of 70 to 85 million euros over five years for an average listed company in Germany. The benefit results from two effects: an efficiency effect through less effort in forecasting and a real top-line effect – through more time to derive effective measures.

Click here to find out more about connected risk intelligence.

Integrated planning and simulation

Future-oriented corporate steering requires efficient planning. Planning involves making strategic decisions, setting sales targets, and working out how to optimise incentives and allocation of resources (e.g. human resources, investments).

Successful, sustainable support of the control processes requires two main prerequisites: Planning must take into account the complex interactions of the value chain while minimising the effort required to map planning processes.

To meet both of these demands, we’ve developed a new approach to integrated planning and simulation. In integrating these processes, we’ve considered a number of dimensions:

- Process integration of strategic planning, partial operational sub-planning and financial planning processes (consisting of P&L, balance sheet, cash flow statement)

- Functional integration across business units (e.g. sales, logistics, production, human resources)

- Integration of planning horizons (long-term, medium-term, budget planning, short-term forecasting)

- Cross-process technical integration

- Data integration, both for master and transaction data

- Methodological integration for parallel use of manual planning (e.g. top-down or bottom-up), statistical approaches (predictive planning) and simulations

.png)

Click here to find out how we combine this approach with modern SAP application tools such as BPCembedded and SAC, where we facilitate simulations, scenario analyses and interaction among planners.

Intelligent reporting

In rapidly changing market environments, up-to-date and accurate information is more important for decision-making than ever before. If CFOs are to successfully play their part in managing and monitoring their businesses, they need modern, highly automated management reporting systems to provide custom, reader-oriented reports.

Intelligent reporting solutions of the future are characterised by their ability to quickly, efficiently and automatically provide results tailored to the user’s needs, while at the same time ensuring standardised, directly comparable reports. PwC Reporting 5.0 is one of these solutions: an app-based reporting with a self-learning, user-specific front end, integrated digital assistant, and an intelligent back-end for report optimisation for highly customised, reader-oriented reporting.

PwC’s Finance and Data & Analytics experts are here to support you in developing your reporting of the future. Based on many years of experience in finance and implementation projects, we support you in the definition of key performance indicators, design dashboard processes and implement cutting-edge management dashboards. We can directly access live data from various sources to report on data in almost real time. Check out our business analytics site for an overview of all our solutions.

Contact us

Gori von Hirschhausen

Partner, Europe Finance Consulting Leader, PwC Germany

Tel: +49 89 5790-6698