“Successful integrators create value by handling newly gained competencies and technologies with care”

20 September, 2017

Executive managers associate a merger or takeover with high aspirations. Sometimes, the expected synergies materialize quickly, at other times, awaiting positive effects does not come to an end. What are the factors influencing whether a deal will be successful in the long term? That’s the question investigated in the PwC study “Success factors in post-merger integration”. M&A integration experts Dr. Rosi Liem, PwC Germany, and Dr. Claude Fuhrer, PwC Switzerland, were interviewed on the most important success factors of post-merger integration.

Ms. Liem, your study investigated the success factors of post-merger integration. What factors influence whether post-merger or post-takeover integration is successful?

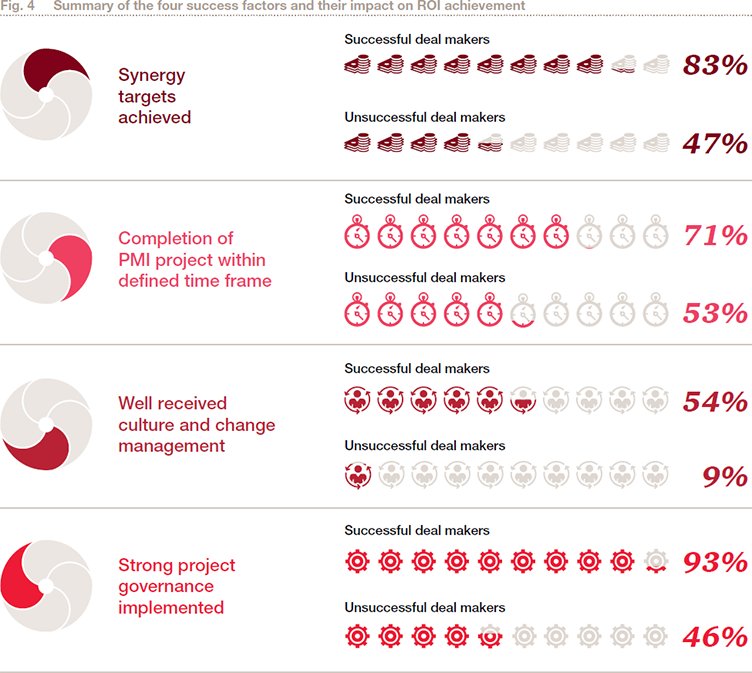

Dr. Rosi Liem: Our analysis shows that the four main factors of the last ten years still apply: Success depends primarily on whether the company is able to generate the planned cost and growth synergies associated with the deal. Secondly, integration speed resulting in the fast implementation of the joint target operating model, greatly impacts success. If integration is achieved quickly, companies can benefit from positive effects quickly, and are able to return their focus to normal day-to-day business. Successful integrators also concentrate on cultural and change management topics and create a stable project structure.

Dr. Claude Fuhrer: We are mostly interested in the extent to which these four factors co-influence each other. Companies who do well in one of these categories also tend to succeed in the other three areas. If you take into account the four mentioned success factors in the course of your PMI process, you stand a good chance of achieving the targets connected with the takeover – such as acquiring new customer segments, building know-how or saving on costs.

What specific recommendations for action can you deduce from these findings?

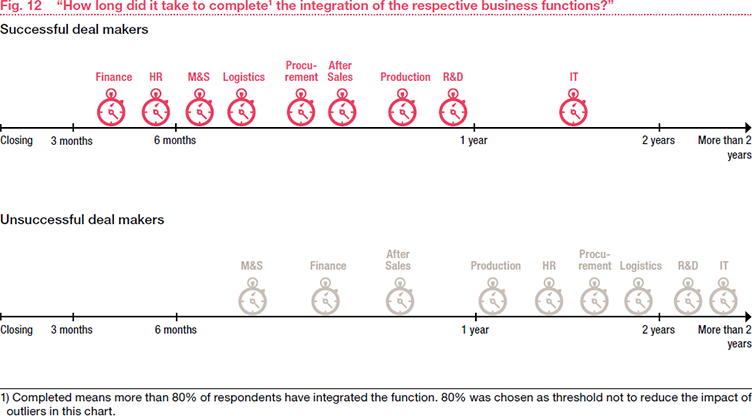

Liem: We can learn a lot from successful integrators: For one thing, they pay higher attention to long-term strategic and growth objectives, and stronger focus on core functions in which new competencies and technologies were acquired. This means that companies should not only integrate support functions, such as Finance and Controlling, HR and Procurement, but also courageously approach core functions such as Research and Development, or Production. That’s very often where highest value is created.

Fuhrer: Our analysis leads to a specific recommendation relating to integration speed: Successful integrators complete most of the integration within one year of closing. However, the difficulty here is to find the right balance between speed and quality. If the integration is executed too quickly, this increases the risk of overlooking important aspects, and thus of making uninformed decisions.

Why is it so important to take into account the soft factors of cultural and change management?

Liem: Cultural and change management are among the most unforeseeable aspects of an integration. It is much more difficult to estimate and bridge cultural differences than financial and operational factors. That’s why we recommend that companies actively plan how they will handle such soft factors appropriately during integration and monitor this systematically. Where small, innovative companies are integrated, it is often very important to not only maintain the innovative power and dynamics that have been acquired, but also to consider in detail how new competencies and behaviours can be transferred to existing teams. Furthermore, in particular where transactions cross borders, as in the case of mergers, building intercultural competencies is considerably important.

Companies who focus their integration around culture and change are significantly more successful in achieving their integration targets.

What is a good way to approach the topic of cultural change in practice?

Fuhrer: Acquiring companies should make especially sure that any key employees from the existing and the new companies stay with them. Not only top and middle management play an important role in this:companies must not forget high performers and knowledge experts at all levels. Managers must approach any cultural change in the acquired company with tactfulness and sensitivity. Key employees will only stay with the company and be willing to invest time and energy in integrating their own company if they understand why they are doing this, and how they can develop their own careers within the new company. This is the only way to ensure a frictionless transition to new organisational structures, operational processes and functions.

Project governance is much easier to plan and implement than cultural and change management. What should companies keep in mind when setting up their project structure?

Liem: A strong project structure is characterised by the following criteria:

On the one hand, it creates the right balance between decision makingin Steering Bodies, and the independent day-to-day-work of the project teams. This must be based on well-thought-through rules, transparent priorities and the right focus of resources and budgets on the most important integration targets. An effective project governance not only speeds up the integration process, but helps to remove any escalations, cultural conflicts and other project risks quickly. It is always possible to plan a robust project governance in advance - and this always pays off as well.

Practical advice from Rosi Liem and Claude Fuhrer, M&A integration experts

This is what matters during integration:

- Synergies: Don’t only focus on cost synergies. Also analyse early on how to create strategically sustainable added value using the newly gained competencies – particularly concentrate on merging core functions.

- Speed: Plan your integration early on. Set your integration strategy and put together your team – ideally at the time of signing.

- Change management: Be sensitive to cultural differences. You might not need a formal process, but should pay enough attention and dedicate enough time to cultural differences and how to handle conflicts. In an intercultural context, it can also help to define rules for interaction.

- Project management: Involve the buyer’s and the target company’s employees in the same way. Carefully appoint the right decision-making bodies, roles and responsibilities to ensure that the project structure remains stable and effective.