Your expert for questions

Steve Roberts

Partner, Private Equity Leader, PwC Germany

Tel.: +49 69 9585-1950

Email

From boom to normality

In 2019, the number of private equity transactions in Europe remained at a very high level. Private equity (PE) is moving from boom to normality, because it generally meets investors' expectations. One of the consequences is an increasingly fierce competition for the most attractive deals. The latest "Private Equity Trend Report 2020" by the auditing and consulting firm PricewaterhouseCoopers (PwC) analyses the most important industry developments in the European PE market. 250 European financial investors took part in our survey.

Overview of the study

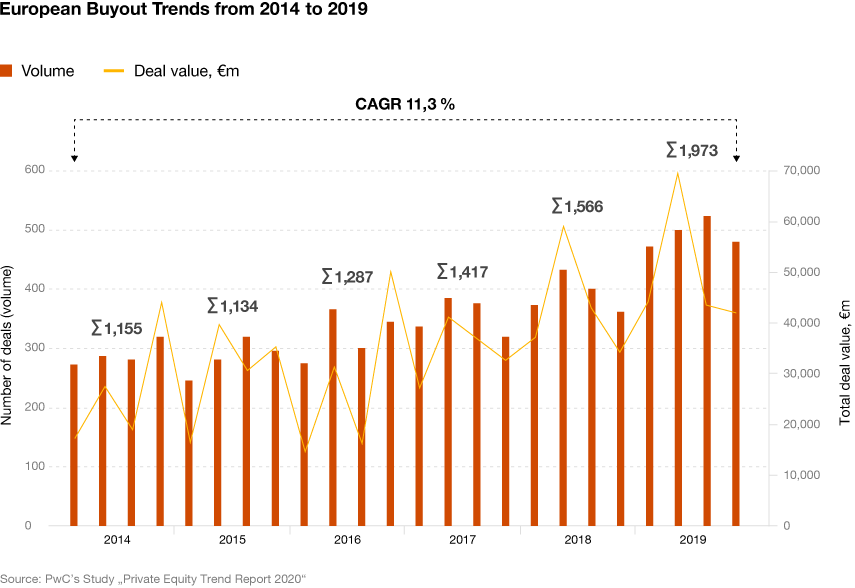

Mega deals lead to high buyout volume

In 2019, a total of 2,515 company acquisitions and sales with PE participation took place in Europe. The transaction volume was 260 billion euros – almost as much as in the record year 2018 (262.1 billion euros). In particular, the number of buyouts rose sharply by 26 percent to 1,973 deals with a total value of EUR 200.7 billion (+15 percent). The main reason for this is the increasing number of mega deals, i.e. transactions worth more than one billion euros. 47 such deals were made in 2019.

In the same period, only 945 exits took place – exactly the same number as in 2018, with the figure falling by 13.3 percent to EUR 121 billion, the lowest level since 2013.

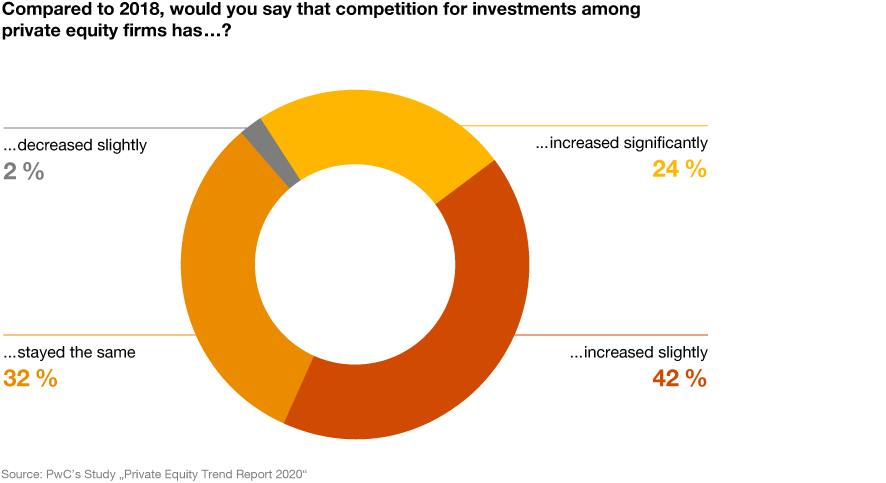

Competition for the best deals is getting tougher

€2.3 trillion is currently estimated to be the uninvested PE capital in Europe. This large amount of “dry powder” leads to increased competition for the most attractive investment targets; two thirds (66 percent) of the financial investors surveyed named this as the greatest challenge (42 percent: “competition increased slightly”, 24 percent: “competition increased significantly”). The respondents therefore also expect that there will be more PE houses in the next three years.

“The overabundance of dry powder we are currently observing usually leads to higher prices and lower investment returns. But the increasingly fierce competition for takeover targets is accompanied by PE investors setting ambitious plans and targets for the acquired companies and implementing them during the holding period and so driving value creation, which in turn drive returns.”

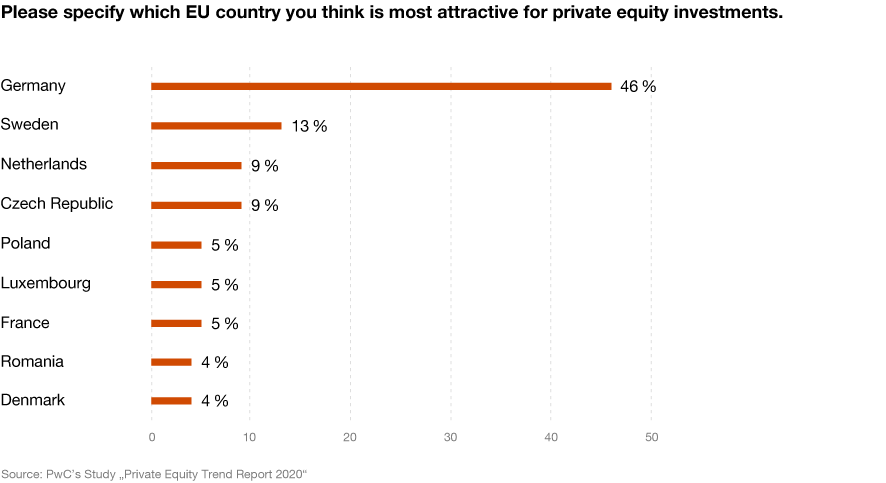

Germany makes it top of the list for PE houses in 2020

PwC also asked the financial investors what consequences they expect for the European PE market from Brexit. 6 out of 10 financial investors said that the UK's exit from the EU made the country less attractive for PE investments (39 per cent: "Brexit has no impact", 1 per cent: "Brexit makes UK more attractive for PE investments"). On the other hand, almost a third (32 per cent) of respondents felt that Brexit made the other EU countries more attractive.

Germany, in particular, will become the focus of European PE houses in 2020: 46 percent see it as the most attractive country for PE investments – and by far: In second place, the respondents named Sweden (13 percent), followed by the Netherlands and the Czech Republic (nine percent each).

Methodology

250 european financial sponsors took part in the survey. Job titles include partner and managing director. 14% of these funds are based in Germany and 14% in Benelux

countries, with the remaining 72% based elsewhere in Europe. All PE firms of respondents had a minimum of €250m of assets under management.

“In the past, the strong German SMCs, the Mittelstand, has been rather hesitant to sell to private equity. However, scepticism is disappearing more and more, so that many investors are looking for long-term investments in companies with a high level of industry expertise.”