Your expert for questions

Gunther Dütsch

Partner, Sustainability Services & Climate Risk at PwC Germany

Email

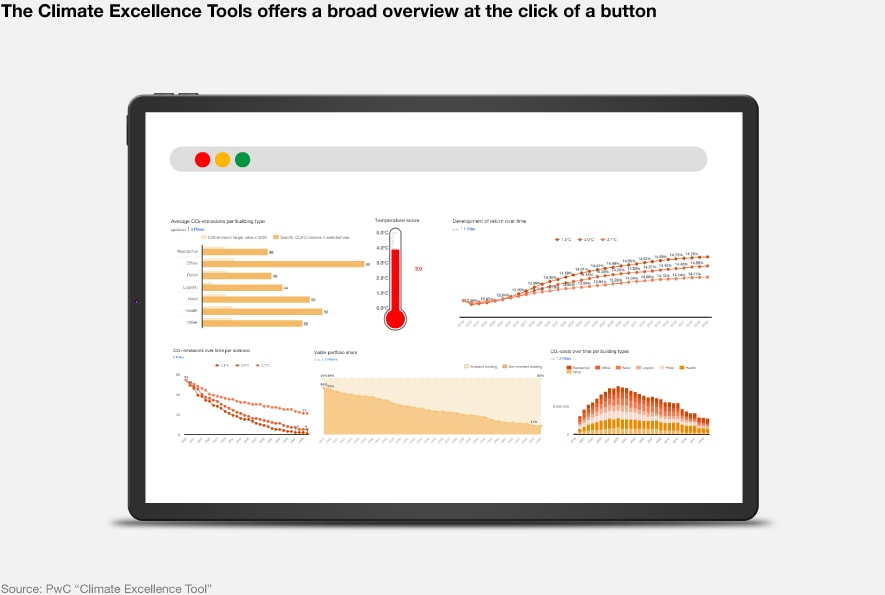

PwC’s “Climate Excellence tool” for climate scenario analyses

PwC’s “Climate Excellence tool” supports companies from the financial and real economy in conducting climate scenario analyses to make their portfolios fit and future-proof for the risks and opportunities of climate change. This enables them to realize increases in value, adequately manage risks, and set up a long-term sustainability strategy and compliant reporting.

Climate Excellence

Climate change forces immediate action

Increasing occurrence of climate disasters

According to the Intergovernmental Panel on Climate Change’s Sixth Assessment Report, climate change is becoming more drastic and the critical global warming mark of 1.5°C is likely to be exceeded by 2030. Global warming is leading to increasingly frequent and severe weather extremes.Climate change and climate protection are having an ever greater impact on economic developments. They also entail major financial risks: From power plants that do not come on stream, to the electrification of individual transport, to the increasing energy requirements for buildings.

More and more complex regulations

The pressure to act on the part of politicians is increasing. The EU is supposed to be climate-neutral by 2050. A joint effort that requires a radical turnaround – also for companies, banks and insurances.

Regulators such as the European Central Bank (ECB) or the European Insurance and Occupational Pension Authority (EIOPA) emphasise the importance of this goal, for example in the ECB consultation paper on climate risks and the guideline for non-financial reporting or in the EIOPA application guidance on climate change materiality assessment and climate change scenarios in the own risk and solvency assessment (ORSA). Additionally, more and more reporting requirements like the framework of the Corporate Sustainability Reporting Directive (CSRD) and the EU taxonomy are already shaping the necessity for climate risk analysis and management of financial institutions and the real economy.

Overview of Regulations and Requirements met by Climate Excellence

EU Taxonomy DNSH2

Requirements:

- Materiality assessment of all taxonomy-eligible activities

- State-of-the-art climate projections covering at-least one high-emission scenario

- Coverage of required 28 risk categories

- Time spans adjusted to life-time of assets

- Business specific vulnerability assessment

- Adaptation solutions for all material risks

- Site specific analysis & measures

CSRD ESRS E1

Requirements:

- Detailed process and scope description

- State-of-the-art climate projection, covering one 1.5°C and one high-emission scenario

- Multiple time spans & their linkage to business plan

- Assessment of own operation (assets and business activities) and supply chain

- Coverage of all 28 physical risk categories

- Consideration of transition risks regarding policy changes, new technologies, market shifts and reputation impacts

- Assessment of policies and resources for climate change mitigation and adaptation

- Validation of ability to adjust or adapt strategy and business model to climate change

TCFD / ISSB IFRS S2

Requirements:

- Gap analysis

- Assessment of current governance structure and advise on enhancements

- Advise on scenario selection

- Identification of key climate risks and opportunities

- Evaluation of financial impact for most material climate risks and opportunitites

- Advise on business strategy to mitigate risks and benefit from opportunities

CRR II Disclosure

Requirements:

- Estimation of energy efficiency in Europe and the US for any real estate assets based on proxy data

- Identification of top carbon-intensive firms

- Sector specific physical risk exposure, disaggregated by acute and chronic risks

EZB stress test

Requirements:

- Financial impacts for multiple climate scenarios

- Assessment of physical and transition risks either separately or combined

- Quantification of financial impact for more than 7 different climate hazards

- Vulnerability assessment

- Results delivery on multiple granularitess, from counterparty to country and sector level

BaFin / PRI

Requirements:

- Climate risk data for multiple scenarios

- Assessment of physical and transition risks either separately or combined

- Results delivery on multiple granularitess, from counterparty to country and sector level

EIOPA ORSA

Requirements:

- Materiality assessment of climte change risks

- Detailed description of methodological approach

- Resilience & robustness test of the business strategy under different climate risk developments

- Assessment of different climate risk scenarios, covering at least one 1.5°C and one >2°C scenario

- Coverage of short-, medium-, & long-term

- Qualitative and quantative assessment

Video series: ESG regulations

In this video series, we give you an overview of current ESG regulations and the key aspects of materiality analysis, as well as the ECB stress test.

Climate risks are expensive

The TCFD predicts that climate change could put $43 trillion worth of fixed assets at risk by the end of the century. According to a CDP study, the world’s 215 largest companies put the impact of climate risks on their businesses at nearly US$1 trillion – many of which are likely to come due within the next three years. This is due to dynamic market conditions, physical impacts and increasing regulation. To meet climate and energy targets by 2030, the EU Commission expects an additonal annual investment of up to €260 billion per year. The Sustainable Europe Investment Plan is part of the European Green Deal and aims to support both public and private investment in climate projects of at least €1 billion between 2021 and 2030.

Increasing pressure from stakeholders

How can companies maintain their "license to operate" and prove themselves in rapidly changing markets? The EU Action Plan, the Network for Greening the Financial System and other stakeholders are increasing the pressure to integrate climate-related risks and opportunities. Society, politicians, suppliers, investors and customers are increasingly demanding more transparency and action.

“Climate change is changing the way we know how to do business. In the future, every company will have to consider the risks and opportunities from these changes in its strategy.”

Climate Excellence Tool

Making climate risks and opportunities transparent and assessing them with Climate Excellence.

Many questions arise with regard to climate change and possible impacts:

- How will climate risks affect my portfolio or my company financially in the future?

- How can I protect myself against these risks?

- How do I exploit future potential as a value driver?

- Where do I stand in comparison to the competition?

- How can I efficiently implement the recommendations of the TCFD (Task Force on Climate-related Disclosure), the regulatory authorities and the CSRD (Corporate Sustainability Reporting Directive) in my reporting?

The PwC Climate Excellence tool helps you answer these questions quickly and reliably. The tool’s scenario analyses give you maximum transparency on your portfolios by analysing and visualising financial impacts of climate change.

Climate change-related opportunities and risks are calculated on the basis of various climate scenarios and energy system models. Transitory risks, such as changing prices, demand, technological advances or regulation, as well as physical risks are taken into account. We analyse seven natural hazards that are particularly relevant for the analysis of physical climate risks: Heat waves, floods, thunderstorms, tropical cyclones, wildfires, droughts and sea-level rise.

How does Climate Excellence help me?

Climate Excellence is already equally suitable for both the financial and the real economy. The aim of the tool is to cover all industries and sectors in detail. For this reason, PwC will regularly publish new modules in a rapid release rhythm. You will always find news about the releases on this website and on our social media channels.

Customer feedback and use cases

“Using the Climate Excellence tool has enabled Solvay S.A. to quantify climate-related transition and physical risks and opportunities of our business and to test our strategy for resilience against these risks. The PwC-Team facilitated the tailored approach that took specifics of our business model into account. The results made it possible to communicate this topic effectively internally and externally.”

Michel Washer,Solvay S.A.Further Information

Get started!

Below you can find more information and a link to purchase the tool in the PwC Store

“In the future, every company will have to consider the risks and opportunities of climate change in its strategy. Risk identification and assessment is the first important step.”

Gunther Dütsch,Partner, Sustainability Services at PwC GermanyContact us

Gunther Dütsch

Partner, Sustainability Services & Climate Change, PwC Germany

Tel: +49 160 3739019