Leagues and Tournaments: The powerhouse

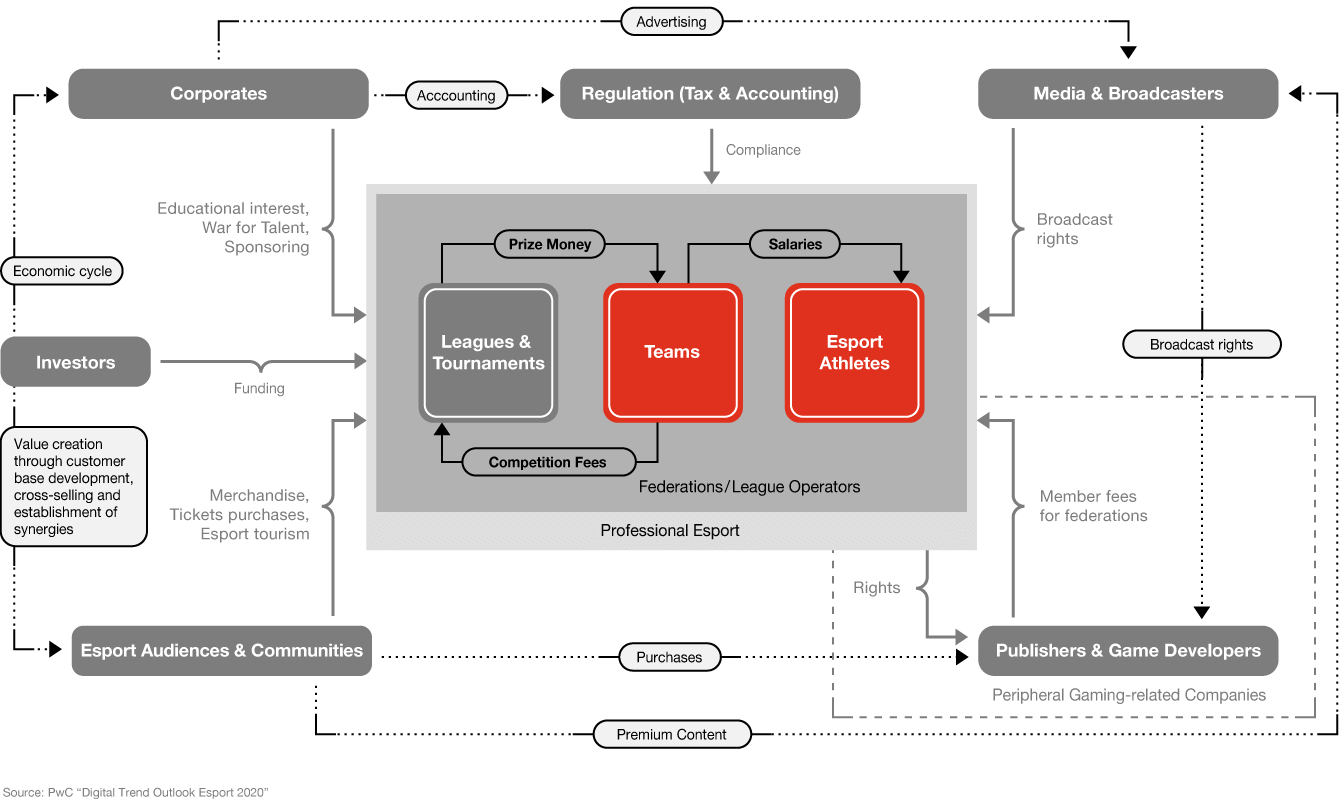

By Disht Advani, Gian Luca Vitale and Koray Anil Akman. One of the central elements in the esports ecosystem is the comprehensive league and tournament structure. It is the skeleton and backbone for the entire esports industry and therefore crucial for a healthy ecosystem and its overall development. Various third-party companies and game developers, run their own leagues and competitions while also planning and producing coverage around them. The selling of the broadcast rights of these leagues and competitions to streaming platforms is an increasingly important source of revenue for operators. Exclusive agreements are commonplace and can sometimes have considerable effects: for example, weekly viewer numbers on Twitch for Counter-Strike: Global Offensive dropped dramatically when YouTube acquired the streaming rights from ESL Pro League. In addition to Twitch and YouTube, which are already established in the scene, Facebook and Twitter are now also involved in the streaming of esports content and the required deals with the teams and league operators. Currently, esports events can be watched both live and on demand

without paying a subscription fee. Besides streaming rights, league organizers can monetize esports through actual ticket sales, and there is also a growing number of TV deals and partnerships with smaller tournament organizers in growing regional markets. The number of competitions and providers of such competitions has increased significantly, especially in the semi-professional and amateur sectors. In addition, we have seen an increase in the number of platforms, which makes it possible for almost everyone to organize and offer tournaments and events. We see the current period as an age of stronger diversification in all levels of competitions. It is clear that players are now developing a sustainable strategy and reflecting this in their product and service portfolio before a renewed wave of consolidation occurs in the future. Now is the time to be much more aggressive in the market and promote the offer. Rewards will be given to those who offer a consistent, transparent and complementary league and competition system at all levels.

An increasing number of universities offer esports programs

The National Association of Collegiate Esports states that more than 170 US colleges currently offer varsity esports programs, thereby awarding $16 million per year in scholarships. More and more universities are also starting to offer esports courses. One example is Pearson College London, which announced it would offer a Business and Technology Education Council (BTEC) degree to students starting this September. Recently, German universities have started offering esports courses as well, such as Campus M University in Munich and its bachelor degree program in media and entertainment with a focus on esports and gaming. The courses aim to equip students either to become professionals in the field or to understand the business aspect of the esports market. Combinations like these bring more sustainability to the ecosystem as students additionally learn a lot about digital technologies and business administration, which they can also leverage outside the gaming and esports market.

Europe is still far behind Asia regarding the selection of courses at universities and the potential of player acquisitions. In Asia, it is normal for gaming scouts to observe students as they play during such courses. If they see someone who fulfills their requirements to become a professional gamer, they offer a contract to become a part of a team. This bridge between a university and a team is important and needs to be established in Europe. Otherwise, there will be a higher probability that Asian teams will overrun European ones in terms of success.

The engagement of universities in esports helps players and universities alike. Universities have the opportunity to integrate modern technology topics in a playful way while creating new motivational incentives in teaching and increasing the students’ identification with the institution.

Increasing esports options at universities is of the utmost importance for the esports ecosystem. A big challenge for younger players who have not yet made it to the top leagues or tournaments is that they do not receive enough attention, making it difficult for them to earn a living from esports. The lower visibility of minor leagues also results in the lower leagues being less lucrative for sponsors. Universities offer a way to increase the player base by supporting players not only with the needed equipment but also with other resources such as coaches.

Competitive leagues for each level of skill are very much needed to help esports take the next step. The players in the top leagues can make a living off of esports, with some even earning millions every year. The lower leagues are all about fun, which means that the players do esports as a hobby and they can't make a living from the income. The leagues in between—with gamers who only play as a hobby and a handful of professional players–pose a bigger problem. In this middle range, players have to invest a substantial amount of time to make the jump to a professional team. In order to avoid a big gap to the top leagues, it is important that they receive the needed support to be able to get sufficient practice. Here, university esports will be a critical factor for the ecosystem and could provide new opportunities for the whole industry.

Mobile esports offers tremendous growth potential for the whole industry

The relevance of this area lies in creating a further entry channel. Players appear to be getting a taste for competitive gaming through this format and are interested in other league products and competitions on other platforms. Statista estimates that there will be 3.8 billion smartphone users in 2020. Because of that, many publishers of popular PC and console esports titles are releasing mobile editions to address a broader audience and to generate additional revenue. Mobile gaming offers a host of important advantages compared to PC and console gaming. Playing on smartphones offers a much easier entry into competitive esports because mobile gamers can play without a console or PC. This is important, since equipment is still a real barrier to entry for consumers, especially in developing countries such as India, yet access to smartphones is easier and more widespread than ever before.

Recent successes are fueling the increase in the number of mobile gaming leagues. The Free Fire World Series 2019, which took place in Rio de Janeiro, had an average viewership of 1.2 million and a peak viewership of 2 million, exceeding the viewership of all other tournaments in the mobile gaming industry. The reason for the increasing amount of mobile gaming leagues is that many high-profile games are also offered for smartphones. Not every gamer owns a PC or a console, but almost every gamer owns a smartphone. The mobile gaming league trend continues in 2020, with 5G technology ensuring flawless streaming.

In the medium to long term, mobile gaming will serve as a major catalyst to the growth of the overall player base, since casual entry into mobile esports makes it more likely that players will use these technology options as a springboard toward PC or console gaming. Even though they might not list gaming as an interest, 8 out of 10 respondents still play at least one mobile game.

According to Niko Partners China, 62% of Chinese gamers are strongly drawn to esports, compared to only around 18% in the US.* Jeff Chau, a professional mobile pro gamer and founder of the company GameGether, emphasizes that mobile esports have helped make esports more mainstream in China and urges the US to follow China’s lead in order “for esports to continue growing rapidly mainstream.”

*Numbers for China from June 2019; US numbers from December 2016

Franchising versus promotion and relegation: both systems are needed and can lead to success

Leagues with franchising teams originated in the US and are common in all relevant US sports leagues, such as the NFL, NBA or MLS. One advantage of franchising is that organizers, investors, media companies and teams have a higher level of financial security, since the buy-in ensures that the teams remain in the league regardless of their performance.

Promotion and relegation, on the other hand, is the most commonly used system in Europe and can be found in all of the region’s soccer leagues, such as the Premier League and the Bundesliga. Esports fans in favor of promotion and relegation argue that games are more exciting with this system, since there is more on the line for teams, and that this system does a better job of fostering talent development. The promotion and relegation system allows strong players to climb the ladder and prove themselves in bigger leagues, thereby establishing a new path and significantly increasing the possibilities to attract potential partners. In the franchising system, it would be impossible to join those leagues without financial power no matter how well the players play.

One of the most successful esports titles, League of Legends (LOL), has been relying on franchising for some time now. LCK, the Korean top league for LOL competition, has announced that it will also be franchising from 2021 on, following the leagues in China, North America and Europe. Other publishers such as Blizzard, with the game Overwatch, have had great success with the franchising system as well, but there are many other esports games and leagues using other systems. Dota 2, for example, which is very similar to LOL in terms of the game idea, does not rely on franchising. As part of this different approach, Valve, the publisher of Dota 2, allows other tournament organizers to run their own tournaments (unlike Riot Games with LOL).

New leagues are being established across Europe. The most recent milestone was the introduction of the European League of Legends league. The league applies the franchising principle where teams have to pay to join. The German football club Schalke 04 has invested €8 million to join the best European league for League of Legends. Later franchise slots were even allocated for higher amounts or sold at a higher price by existing franchise slot holders on exit. We will most likely see more such franchise leagues in the future.

There is still no clear trend as to which system will prevail in this agile esports world. It may well be that different systems like franchising or promotion and relegation will continue to exist parallel to each other in the long run. Ultimately, the system that is best for all stakeholders for each single game is what is best for the industry. As esports is still in an early growth phase, it will be crucial for league operators to focus on approaches that allow the ecosystem to grow organically and self-sustainedly rather than having to rely on massive investments. Some gig investors have no intention and no patience to follow a long-term growth and support strategy. In the long run, however, one system per game may prevail and we will see a winner takes it all phenomenon. What is certain is that right now the foundations are currently being established and investors make their respective moves for the competition between the systems.

League operators experience more competition from publishers

The balance of power in the esports ecosystem is clearly distributed, since publishers hold the intellectual property (IP) rights and are therefore able to determine who is allowed to host and broadcast a tournament. This is in direct contrast to traditional sports. The Bundesliga does not own soccer, and the NFL does not hold a patent on football. Theoretically, a new league with its own rules could be founded tomorrow and the Bundesliga would be unable to do a thing about it.

However, the situation is very different in esports. Without a contract, or after the expiry of a contract between a league operator and publisher for the rights to host events, a publisher could very well decide to take the organization of events into its own hands. Besides the potential direct profit, this also gives the publisher the chance to use the tournament or the league as the optimal marketing tool for its own game. In the early days of esports, publishers did not care much about the esports scene around their game and were more focused on the mass gaming market instead. Operators should therefore start their venture into gaming with short-term, realistic goals and then expand steadily from a solid base.

The publisher of LOL, Riot Games, hosts its tournaments itself—with huge success. The 2019 League of Legends World Championship was watched by more than 100 million viewers. This allows Riot Games to remain in tight control and receive the profits, but also devours resources that are no longer available for the core competency of the business: the development and updating of new games. Because of that, most publishers license their broadcasting rights and will probably continue to do so.

For league owners, the collaboration with publishers is absolutely crucial. Long-term contracts can help league operators, investors, teams and players alike obtain greater security. Fast-moving league operators have the advantage that most publishers still have a relatively low focus on esports and are very happy to enter into strategic partnerships. League operators need to ensure that they do not get used for early stages of esports titles, where publishers establish a testing ground and want to avoid early investment risks, and then get dropped once a more stable esports scene has been established. To illustrate this, Riot Games is planning a more open ecosystem for Valorant that will allow third parties to organize their own competitions. Nevertheless Riot Games always defines the strategic direction and the overall framework.

Physical esports events keep the fire alive—but purely online events have proven to be a true alternative for more differentiation

Today’s esports events are comparable to the largest sporting events in terms of dimensions and viewer numbers, and sometimes even surpass them. The biggest global events are the World Championship (LOL), The International (Dota 2) and the PGL Major (CS:GO). Within these tournaments, millions of dollars in prize money are awarded, captivating thousands of viewers on the ground and on screen.

The global COVID-19 pandemic has had a noticeable impact on the organization of physical esports events this year. League matches are watched and played remotely, but the deciding final games of the leagues are usually played at physical live events. Due to the global pandemic, professional gamers have been forced to play remotely, and viewers have been forced to watch the games remotely. Gaming and esports are winners of the pandemic due to increased numbers of players, streaming, hardware sales, and online events. Nevertheless the pandemic had a negative impact on live events and as a consequence on merchandising and ticket sales. Physical esports events are one of the key factors in the esports industry. The physical events ensure the establishment of sponsorships and joint venture opportunities. Both are key drivers for generating revenue in the esports industry. The physical events deserve particular mention, as they strengthen the bond of the community and convey a sense of belonging, much like traditional sporting events such as soccer matches or the Olympics. Moreover, it is important to understand that the success of esports relies heavily on such events, as the character of esports has a strong physical, virtual and social dimension. In the future, events are likely to evolve into festivals combining music, fashion and lifestyle, food experiences, culture, competition, education and esports in one.

The gaming industry has already redefined entertainment—and live events are next. In the US and western Europe alone, more than 12 million gamers have attended live esports events in person. Gaming tournaments have become so popular that organizers have attracted sponsors like Coca-Cola and American Express. Live esports events are a huge driver for participants to both play and purchase more.

Instead of playing or watching esports at home alone or in small groups, fans are seeking more opportunities to come together in person by the thousands to sharpen their skills and watch their favorite players and teams compete live. More than 48 million gamers in the US and western Europe watch or participate in esports, and over a quarter of those participants attend live events. These record-breaking numbers are continuing to skyrocket year after year, inspiring the whole esports ecosystem.

Furthermore, esports events are continuously developing in other aspects as well. One aspect is the desire for more exclusive opportunities that a gamer could only experience at a live event, or ways to have a more VIP experience. Many gamers want ticketed access to pro-player team meet and greets. Gamers are also looking for a broader variety of things to play and do at the actual event. Attendees prefer the presence of games everyone can play, or a kind of mini-tournament within the larger tournament. Many gamers also want more interactive activities built around the event, rather than simply watching. There is also a desire for musical artist performances and cosplay competitions.

For many attendees, sessions on how to improve their game, such as training for special in-game content, would make an esports event really stand out. These expos are one way to encourage the audience to become more invested in the game while also promoting the purchase of their own content.

For esports leagues to tap into bigger advertising budgets, they need to exist on national, regional and global levels as traditional sports does. Few advertisers have a significant global advertising or sponsoring budget, as most marketing money is spent on a local level. Currently, only LOL has a structure that resembles this hierarchy, with regional league structures in North America, Europe, southeast Asia, Oceania and Latin America, as well as country-based league structures in China, South Korea and Turkey.

Future esports events will be a mix of tournament and gaming expo, which will allow attendees to experience the full esports ecosystem live on the spot. We also believe that league organizations are a potentially attractive segment for external investors to consider due to their reach and broad range of revenue sources. Mobile gaming has the potential to accelerate growth but may be limited to Asia alone.

Events, as a central aspect and driver of this industry, will regain importance once the pandemic is over, especially for the further development of leagues and competitions.

Due to the positive experiences during the pandemic, digital events could also play a greater role in the future, especially for the semi-professional and amateur sector. This is due to the fact that online events are often more cost efficient than offline events, as well as the natural expansion of the portfolio and the possibility of opening up new monetization opportunities in this segment.

Contact us

Werner Ballhaus

Global Leader Entertainment & Media, Partner, PwC Germany

Tel: +49 211 981-5848

Gian Luca Vitale

Gaming & Esports Business Advisory, Senior Associate, PwC Germany

Tel: +49 175 8534-794

Contact us