Regulation (Accounting): The silent hero among the supporting roles

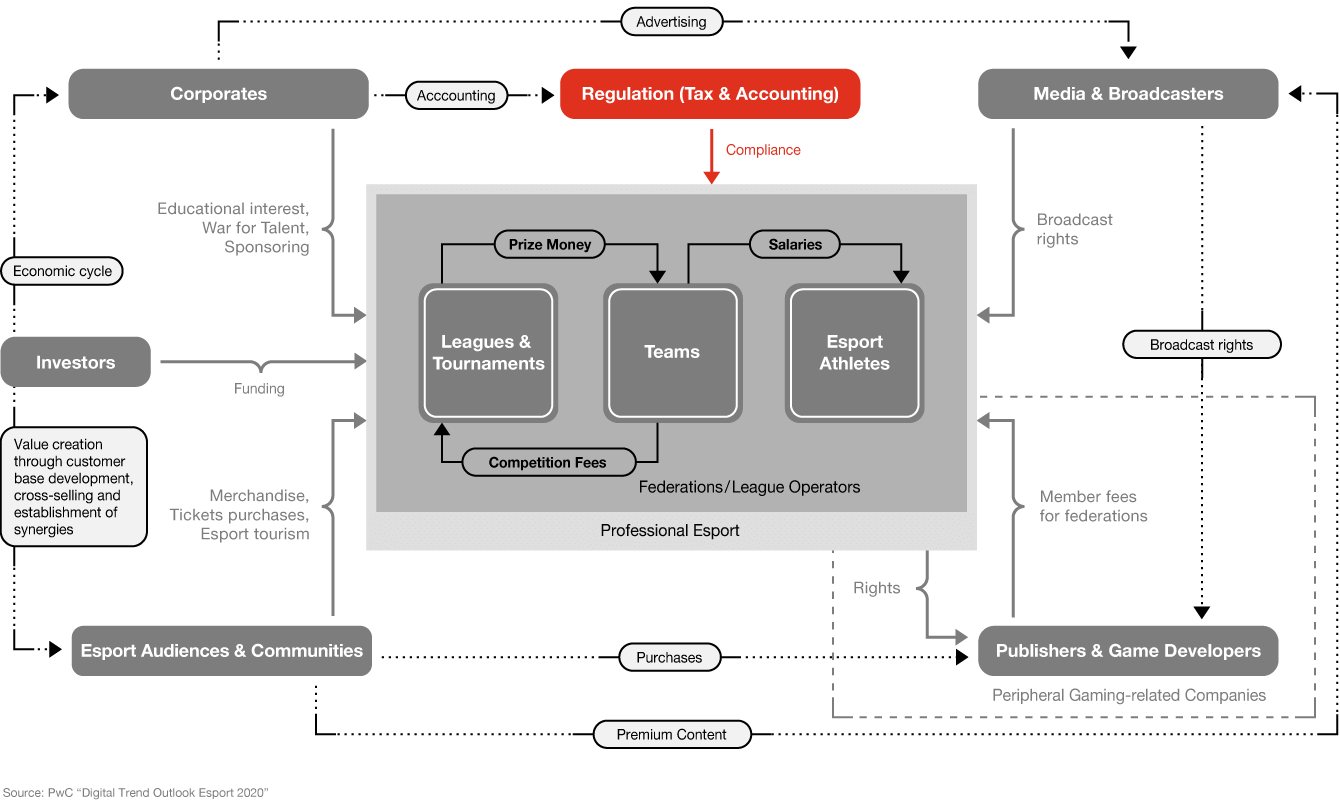

By Maximilian Blome, Stefanie Bubbers. Accounting is not the number one topic that comes to mind when thinking about esports. Yet it is an important issue for all players in the esports ecosystem. How do publishers generate revenue from micro-transactions? What should investors keep in mind when looking at potential esports organizations, league operators or start-ups?

Why is revenue sharing common practice for media companies? All these issues will be covered by this article and should be looked at regarding the future growth of esports. The primary focus of this chapter is to understand what is facilitating the growth of the up-and-coming esports industry.

IT systems – the backbone and the Achilles’ heel of the esports ecosystem

IT is omnipresent and inherently linked to the topic of esports at every point in the value chain, such as providing the server capacity to host tournaments and the server infrastructure within esports titles to hold matches. The importance of this topic could be seen at the FIFA 20 Summer Cup Series Europe in July 2020, when the game experienced several severe server lags during the finals. Slow game play and other technical difficulties caused a lot of community criticism of Electronic Arts (EA).

Esports is a fast-growing industry. With attention comes an increase in the money generated in the ecosystem, making it a target for cheats, hacks and cybercrimes. Players may employ unfair means to gain an advantage, using illegal cheats or malware to steal account credentials or even take other accounts hostage. Compromised game play is one of the results, but the loss of accounts or in-game currency can also lead to financial loss for other esports players and ultimately damage the reputation of the publisher, leading in the long run to a decrease in active players and reduced purchases of in-game currencies.

Hackers from outside target esports publishers and event organizers to gain highly sensitive data like banking or credit card information, or other personal data from players. Since most of the popular esports titles are free to play, publishers generate huge revenues from in-game micro-transactions. Nearly 70% of Fortnite players say they spend money in the game, and those who do spend an average of nearly $85. There are even separate online auction platforms for CS:GO skins, and the bids here are sometimes several hundred dollars per item. A common practice for players is to buy in-game currency and store them in their accounts as a kind of deposit to use later for purchasing skins or other items. All these factors naturally make esports accounts highly attractive to hackers.

IT systems and their security is also a big topic for accounting. For German auditors, it is mandatory to also look at the IT systems and processes during the regular audit of the annual financial statement.

The question of whether an IT system audit is to be performed, and to what extent, depends less on the size of the company to be audited and more on the complexity of the IT systems used, which in turn determines the scope and type of audit procedures to be performed. In fact, the esports ecosystem and the top-tier esports titles are based on a truly complex and international IT infrastructure in order to provide, sustain and grow the 24/7 service to their customers and involved business partners. Riot Games states on its website that it gathers data about nearly everything that happens in live League of Legends matches, including the exact number of times every player worldwide uses their abilities in game.

The IT system audit is divided into two sub-areas. First, an inventory of the relevant IT systems and a risk classification is carried out, followed by an in-depth follow-up audit for particularly risky areas.

Accounting-relevant IT systems must be compliant with the existing compliance and safety requirements. Such systems include areas like IT infrastructure, where auditors have a look at physical safeguards such as fire extinguishers in server rooms, as well as the authorization concept for access to the systems.

As a result, auditors focus not only on conventional finance ERP systems, but may also decide to have a look at the back-end system, where user data and in-game currency is stored, depending on the business model and the data used for generating postings in the finance systems. Since these systems are often not standardized but are self-developed by the publishers themselves over the years, it is important to keep in mind these rather formal requirements for an IT system audit for start-ups and growing companies.

These issues are becoming increasingly complex and are constantly evolving. For example, in the recently released game Valorant, players are no longer able to freely select from different server locations. This region lock, as it is known, means that players based in Europe are automatically assigned to European servers and cannot change this by purchasing Riot Points or by selecting the region in the launcher, as was previously the case. For example, Puerto Rican accounts have been automatically assigned to Latin America and not North America, which means that many players can no longer play with their friends.

Third-party cloud solutions like Google Stadia or the recently announced solution by Amazon understand the complexity of this topic. The main focus here is to make sure to level up the game in time, because different authorities across multiple jurisdictions are not sleeping and more attention will be paid to these topics in the esports ecosystem going forward.

Internal control system—don’t get one-hitted on the path to growth for your business

For smaller companies or start-ups, which can be often found in the esports ecosystem, it is important to keep an eye on internal control systems and framework.

An esports team may start as a way to rank up a league or to solve a user experience problem before evolving into a hidden champion regarding solutions that enable leading platforms. The accounting part always feels like a necessary evil at fast-growing companies, but it is important to not neglect the growth in this department as well.

The requirements facing an internal control framework for a two-person company is totally different from the ones for a mid-sized business. Think about implementing a principle of dual control for certain areas such as payments or changing sensitive master data. Implement certain double checks in order to avoid incorrect postings, and bear in mind that high-level reviews of monthly figures by management should be documented. There are automated work flows and solutions for this, the advantages and disadvantages of which must be weighed according to the growth strategy and the business objective of the company.

Having certain controls in place helps a lot if a company needs an audit of its financial statements, whether it is due to reaching a certain size or during due diligence. If the controls are fully and comprehensively documented, the auditor can rely on these procedures, reducing the size of certain samples. Moreover, a functioning internal control system tailored to the size of a company is nearly always an asset for investors.

Intangible assets—how to account for self-developed games?

Intangible assets in the form of self-developed games are one of the most significant assets in the balance sheet of a game or esports publisher. The games are, of course, the main asset of companies when it comes to monetizing their activities and are the focus of attention for players. Attention regarding accounting for the development of games is paid to costs that are either capitalized or expensed. Both local German GAAP (HGB) and international GAAP (IFRS) differentiate between research and development costs for internally generated intangible assets. While German GAAP distinguishes between the research phase and the development phase, IFRS lists certain requirements for the existence of development costs, which must be fulfilled cumulatively. Research costs must be expensed in HGB and IFRS, whereas development costs are treated differently. In contrast to the German accounting standards, where the reporting company has a choice to capitalize the development costs, IFRS requires capitalizing development costs. The capitalization of costs and the related recognition of intangible assets results in fewer expenses for the current accounting period but leads to expenses in the form of amortization in subsequent years. However, for the higher profit in the current accounting period, it should be noted that the amount attributable to the capitalized development costs is (partially) blocked from distribution under German GAAP.

In practice, a key issue for game developers is to separate the research and development phases. To determine the point of time for moving from the research to the development phase, a company can consider different (test) launches of a game. To capitalize development costs, it is necessary not only to separate the research and development phase, but also to record the different cost components. The accounting systems define which kind of costs can be treated as development costs. For example, costs like overhead or personnel costs that are proportionally attributable to the development of games must be recorded and distributed in a comprehensible manner. Lump sum amounts cannot be capitalized.

To calculate the annual amortization, it is common practice to use the average lifetime of a game. Due to a lack of empirical data, start-ups must determine a reasonable useful life.

During both the initial and further development of games, it must be assessed whether costs can or must be capitalized. Esports games have a fast development cycle, with new heroes, weapons and maps constantly released to further engage the players in the game. Therefore, a game or esports publisher has to evaluate whether new game features have been created and whether the game has been further developed, making it possible to capitalize costs or just expense costs incurred in the context of bug-fixing and other maintenance activities. To determine whether a game has been developed further, KPIs that measure the impact on gaming demand and behavior may be considered.

A further aspect for subsequent measurement of intangible assets under IFRS is the annual impairment test. Irrespective of whether there are indications of an impairment, an impairment test must be performed annually for intangible assets, such as league tournament rights. The reporting company must consider internal and external indications of impairment, such as unfavorable future changes in the use of the intangible asset or a reduction in market value. An impairment is required if the carrying amount of the asset exceeds the recoverable amount. In the case of league tournament rights, it could be considered whether newcomers are asked to pay an equal price for newly issued licenses.

League tournament rights—franchise systems as an answer to growth in the ecosystem, making the rights worth more than gold

Intangible assets are also relevant for esports teams and organizations. Apart from player’s rights, league tournament rights are of importance. Game developers are increasingly focusing on franchise systems, where esports teams or organizations buy highly valued slots to participate in well-known esports leagues. For example, the League of Legends European Championship (LEC), the League of Legends Championship Series (LCS) or the Overwatch League (OWL) are organized in a franchise system. Due to the acquisition of those league tournament rights, esports organizations must recognize intangible assets that are capitalized. Under German GAAP, the reporting company may only use the cost model for the subsequent measurement of intangible assets, where historical costs are reduced by amortization. IFRS, however, additionally allows for the application of the revaluation model. The revaluation model makes it possible to measure the intangible assets at fair value. Hence, increases in value can be recognized annually. A necessary condition for the revaluation model is that the fair value must be determined in an active market. Even if the determination of an active market for intangible assets is typically complex, slots for franchise leagues can be sold by esports organizations so that comparable values may be determined. An application of this method should therefore be examined. For instance, Evil Geniuses bought the League of Legends Championship Series slot from Echo Fox, which was offered for sale by the tournament organizer, Riot Games, in 2019. Rumor has it that the spot sold for $33 million, a 230% increase in the value of an LCS slot over just two years, since Echo Fox paid $10 million for the spot in 2017.

As prices for such slots have already risen in the past, private equity investors who evaluate an esports organization’s financial statements should consider that league tournaments measured at cost may not represent the current value. In order to get a good overview of the current value, several different aspects should be considered, from the publishers behind the game and the active players worldwide, to viewers on streaming platforms and the location of the game in the life cycle. League tournament rights are non-current assets that must be regularly revalued.

Revenue recognition—consumable versus durable goods

Revenue recognition is an accounting topic that is especially relevant for publishers of online games. In conventional online gaming, game publishers generate income through micro-transactions. To enhance the gaming experience, players of online games often have an opportunity to buy virtual currency in order to purchase virtual items. For companies, such micro-transactions not only lead to a source of earnings but also raise the question of how to recognize revenue in the financial statements. After the purchase of the virtual currency was initially recorded as deferred income, there are several aspects to be considered when the user converts the currency into virtual items and uses the items in the game. For both German GAAP (HGB) and international GAAP (IFRS), the reporting company must distinguish between revenue recognition over a period or at a point of time. Therefore, a company must assess when the service is rendered. If the performance obligation is the unique provision of the virtual item, it indicates a revenue recognition at a point of time. This perspective, however, would require a closer look at the general terms and conditions. If the performance obligation is the maintenance of the game for the period of use of the virtual item, it indicates revenue recognition over a period of time. Even if the general terms and conditions do not require the publisher to maintain the game environment, the player’s expectation at the time of purchase is that the item can be used for the intended period. According to this economic point of view, the publisher’s performance obligation is to maintain the game in order to enable the player to use the purchased items. The following examples should therefore illustrate the recognition over a period of time and the assessment when the service is provided.

If, for example, the player purchases emotes in League of Legends or a new weapon in CS:GO, it is necessary to distinguish how long they can be used. Revenue for an immediate and short-term superpower, known as a consumable, should be recognized directly when it is employed. For a durable good, such as a weapon that can be applied for a defined period, revenue recognition should be divided equally over this period. In the case of unlimited use, revenue should be recognized depending on the expected duration of the player’s affiliation. To determine the expected duration a player remains in the game, comparative and historical IT data can be considered.

In order to make the distinction between durables and consumables and the associated accounting effects, it is necessary to have a functioning IT system that provides such data reliably and accurately. The challenges for IT systems in the esports ecosystem have been highlighted above.

In summary, micro-transactions do not affect the publisher’s income statement until virtual currency is converted into virtual items. Depending on the design and the conditions of the virtual items, revenue is recognized when virtual items are utilized. The recognition of deferred income for the sale of virtual currency and the revenue recognition over a period of time for the consumption of virtual items are particularly important for accrual accounting at the balance sheet date. German GAAP (HGB) and international GAAP (IFRS) both require an appropriate allocation of income.

Revenue sharing—a natural duo queue in the esports ecosystem

Accrual accounting for revenue is relevant not only for publishers of online games but also for esports organizations. Sources of income for esports teams include sponsorship money, merchandising, revenue from advertising and streaming, prize money for tournament winnings or revenue sharing. While revenue from winning tournaments is recognized when the competition is finished, and revenue from merchandise is recognized when products are delivered, revenue from sponsorships or from league revenue sharing must be deferred. Sponsorship payments, as one of the key revenue streams in esports, must be recorded as deferred income if they are provided for several years. Revenue is recognized proportionately over the duration of the contract. For subsequent revenue recognition, it should also be examined whether the payments are subject to contractual terms that depend on future developments. If esports leagues and esports teams or organizations agree on revenue sharing, revenue from league operations (such as advertising or ticket sales) are distributed to the teams. For accounting purposes, esports teams or organizations must distinguish between fixed and variable revenue in this case. Fixed revenue must be recognized according to the time frame of the league period, whereas the recognition of additional variable revenue depends on the point of time where the amount can be reliably determined and the service was rendered.

Currently, LCS revenue sharing is split three ways, with the players receiving the largest share of 35% (at minimum) and the rest divided equally between the teams and Riot themselves. If total player salaries exceed 35% of LCS revenue, then the salaries are paid as normal. If the total is less than 35%, then players will be paid the difference. That way, their percentage is always guaranteed.

Each team gets an equal share of half the team money pool, with the remaining half distributed based on league performance and contribution to viewership and fan engagement.

This very transparent approach from Riot helps promote a good and trusting duo queue between publishers and teams and players alike.

Insiders say that most of the revenue-sharing payouts rank between $1 million and $2 million—far more than what franchise owners pay up front for a slot in the leagues. Therefore, the break-even point of the investment will be somewhere in the coming 10 to 20 years, making franchising a really long-term investment, with the risk that games might not exist that long or that player activities may decline significantly over time. In the short term, investors should focus more on media rights and sponsorships, where sustained profitability will probably be gained faster than for revenue sharing.

Contact us

Werner Ballhaus

Global Leader Entertainment & Media, Partner, PwC Germany

Tel: +49 211 981-5848

Contact us