Strategic investing – how to make your investment pay off

25 June, 2020

Your expert for questions

Florian Noell

EMEA Startups, Scaleups & Venturing Leader at PwC Germany

Tel.: +49 30 2636-4176

Email

The different types of investment in startups, and when they're worth it

Exploring promising markets and tapping into new business sectors, innovating without incurring major research and development costs, or simply generating returns: there are many ways for established firms to profit by investing in up-and-coming startups.

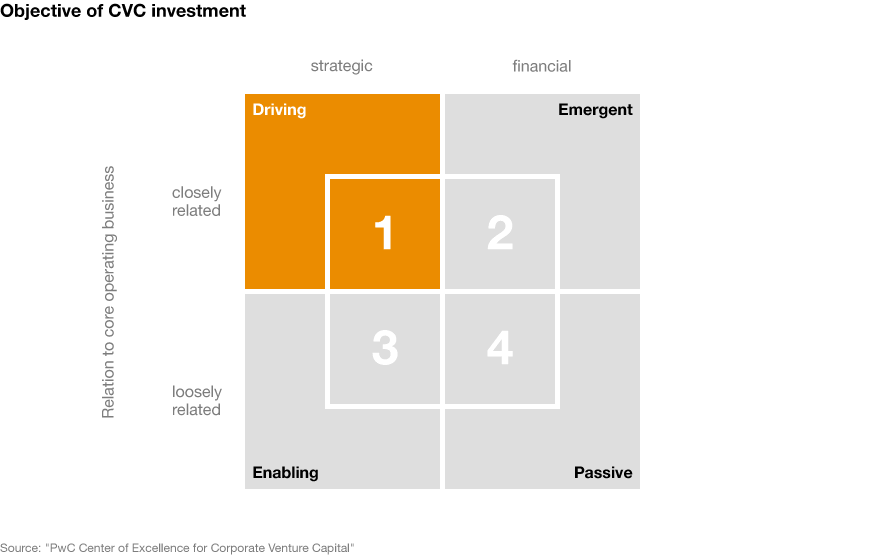

However, companies must carefully examine which opportunities are offered by investing in startups – and know which objectives they are pursuing by making such investments. They are looking for access to highly-qualified talent or promising technologies. Generally speaking, there are four types of investments in startups by companies (corporate venture capital, or CVC for short), depending on the relevant objective. What those are – and which advantages and disadvantages they entail – are familiar territory for Florian Nöll, Head of Corporate Venture Capital at PwC Deutschland.

“The primary goal for investing in startups shouldn’t be a quick financial return. Companies would be well advised to consider corporate venture capital a strategic tool for sustainable growth of their business.”

Strategic, or profit-oriented?

Before undertaking any action, CVC investors should ask themselves two questions, based on the theory put forth by the American economist and innovation researcher, Henry Chesbrough: First, what is the general thrust of the investment: will it be driven by strategic aspects or financial returns? A company looking for strategic investments is primarily seeking synergies between its own business model and the new venture. By contrast, financial investments are centered around achieving an attractive return – and less concerned with whether or not the startup's business model and its product or service offering fit with those of the investor.

The second question a company needs to ask itself before investing in a startup is: how well should the startup fit to our core operating business? In other words: how closely aligned should it be with the investing company's activities?

Tried and tested framework for assessing corporate investments in startups

According to the model developed by Henry Chesbrough, there are four types of VC investments depending on the answers to these two questions. This framework can help companies seeking to invest to assess existing and future investments in startups and determine how they wish to use their investments as a tool for strategic growth.

A clear strategy

No matter the type of investment a company opts for, it needs to fully understand its own strategy and its operational abilities. Moreover, it must manage its investment in such a manner as to ensure that it is able to reap the strategic benefits and is not merely after financial income.

Prospective targets

- Prospective targets

- Emergent investments enable companies to discover new business sectors

- Enabling investments complement the current business strategy

- Passive investments merely seek returns

Prospective targets

When we speak of “driving investments”, we mean those investments where the focus lies on strategic objectives. This enables companies to drive their strategy in the truest meaning of the word. When an established company makes a driving investment, it invests, for instance, in a startup which offers products and services which drive forward a technological standard which the investing company has itself developed. The startup is thus closely involved in the investing company's core operating business.

“From a strategic standpoint, such an investment can make a lot of sense. However, this form of investment is less suited to disruptive strategies or identifying new opportunities. Companies that want to grow beyond their current strategy and processes should therefore not limit themselves to driving investments”, says PwC expert Florian Noell.

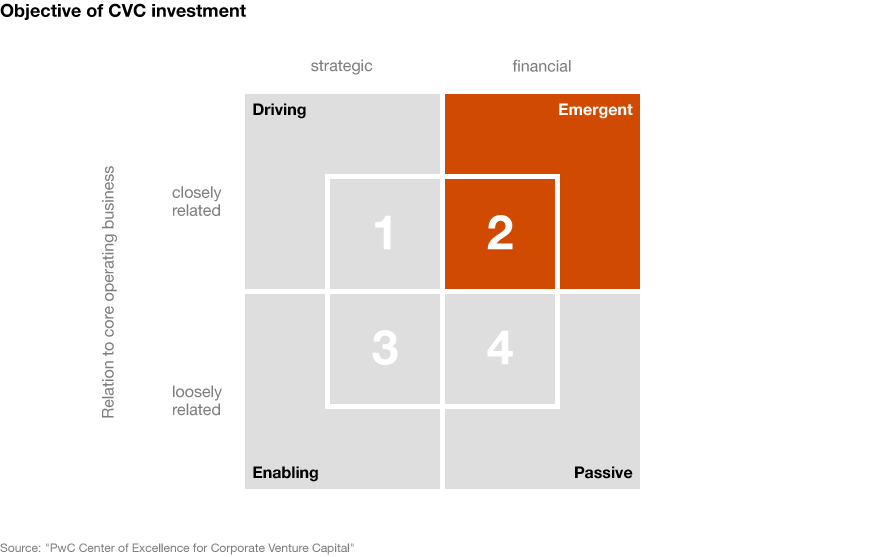

Emergent investments enable companies to discover new business sectors

Under this form of VC investment, the overlap between the startup and the investing company's core operating business is also significant. However, the focus rests on economic objectives. Thus, companies can use emergent investments to promote technologies which they so far have not used or are less familiar with, or they can explore new business opportunities. It is also conceivable for the startup and investing company to share their production facilities and distribution channels, thereby enhancing the efficiency of their own production and distribution processes.

“Emergent” investments are thus suitable, in particular, for experimenting with new technologies and capabilities, or for closing strategic gaps. “Emergent investments are particularly popular in times of economic boom. That’s because when the economy is running smoothly, the chances of solid financial returns are good. This offsets the risk that the investment may not be strategically beneficial”, says PwC expert Florian Nöll.

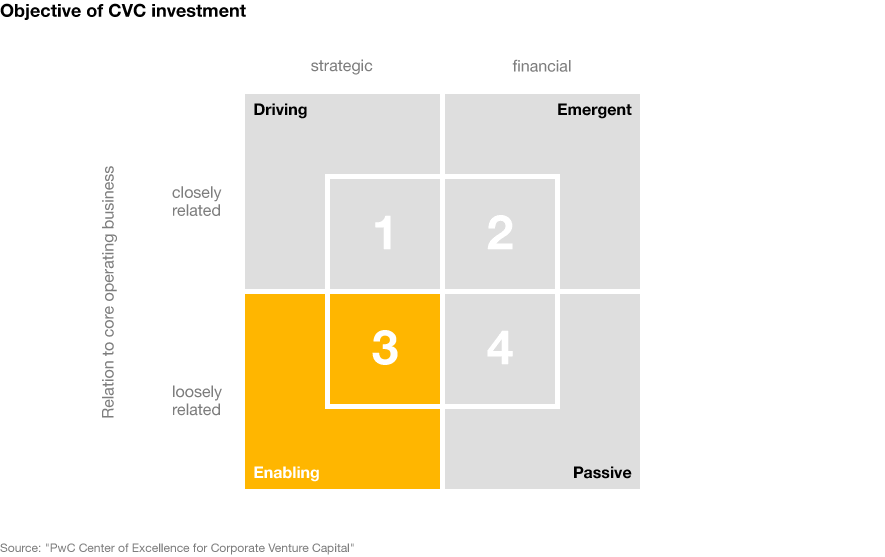

Enabling investments complement the current business strategy

The defining feature of enabling investments is that they complement a company's current business strategy. An established company can use the products or services offered by a startup to boost demand for its own products and services. This type of strategic investment plan is thus developed mainly based on strategic considerations.

However, in the case of enabling investments, the startup is not so closely interwoven with the investing company's organisation or core operating business. A good example of an enabling investment is an investment in a startup that develops products and services that boost demand for the investing company's own products.

“In difficult economic times, these investments may become more expensive and less attractive than other forms of business development. Nevertheless, enabling investments can bring lasting benefits”, says Florian Nöll.

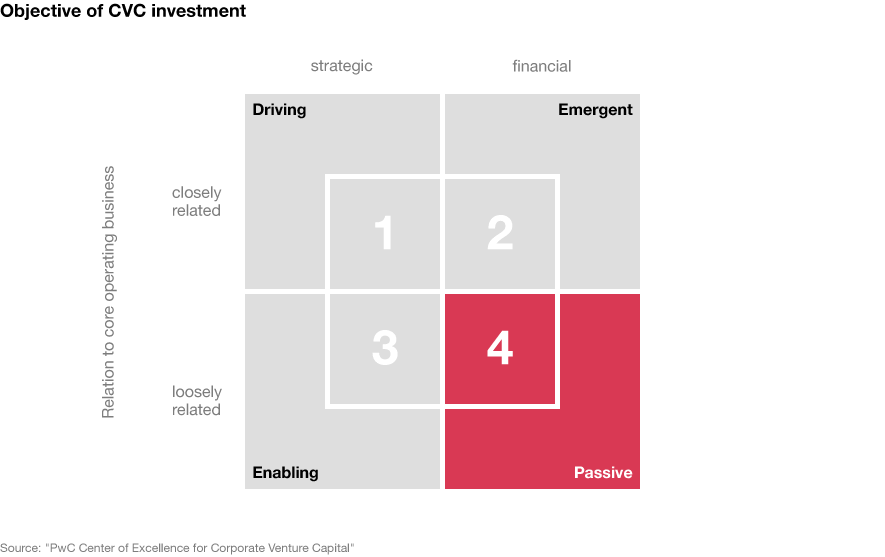

Passive investments merely seek returns

A further option – albeit less popular – is passive investment. In a passive investment, the startup's business model has very little to do with that of the investing company. Most passive investments do not pursue any strategic objective. The investment in the startup is more of a purely financial affair.

“If you take a targeted approach to corporate venture capital and are aware of the various strengths and weaknesses, you should also be able to successfully invest in innovative startups in difficult economic times, thereby generating valuable growth.”